How Regulated Investment Crowdfunding Fueled Impact-Driven Startups in the First Half of 2025

From Clean Energy to Inclusive Consumer Brands, Reg CF Campaigns Backed by Everyday Investors Show Strong Growth Across Diverse Founders and Platforms

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

Every Sunday, we bring you a roundup of the most successful impact crowdfunding campaigns that have achieved their funding goals. Join us to celebrate the impact and innovation that these ventures have brought to life. To make sure you never miss an update, move our emails to your Primary inbox in Gmail or mark them as 'Not Spam' in other email services.

Over the first half of 2025, U.S. Title III crowdfunding (Reg CF) showed a seasonal pulse: a strong spring surge giving way to a summer slowdown. In January 2025, Reg CF platforms raised $33.97M, led by StartEngine ($8.3M) and Wefunder ($7.27M). That total fell to $26.00M in February, a 23% drop off January’s pace, and roughly 35% above Feb 2024. March then saw a dramatic rebound: startups raised $44.69M (a 58% jump MoM), exceeding both the January–February totals and March 2024’s ~$34.2M. April remained high: Reg CF platforms took in roughly $41.6M (nearly matching March), capping tax‐season campaigns. By May and June the pace cooled – roughly $27–28M in May and $23.9M in June. (For comparison, June’s $23.93M was down from April’s $41.55M peak and slightly below June 2024’s $26.82M.)

Top Platforms & Campaigns

Across all campaigns (only U.S. raises), the same dominant portals continued to lead funding. Wefunder and StartEngine have consistently topped monthly totals. For example, in Q1 2025 Wefunder logged ~$17M in April and nearly $10M in March, while StartEngine raised $9.2M in April and ~$6.5M in March. DealMaker Securities (Reg A-focused) also had strong months ($4–5M in Spring). Other active platforms included Republic, Netcapital, Honeycomb, CrowdFund My Deal, and Climatize. In June 2025, for instance, StartEngine led with $7.26M raised, Wefunder $6.10M, DealMaker $4.67M, followed by CrowdFund My Deal ($1.51M) and Honeycomb ($1.46M). Over 2024, the top platforms (Wefunder $99M, StartEngine $86M, DealMaker $49M, Republic $15.6M) captured 67% of all Reg CF capital.

High-profile campaigns also boosted totals. Large raises (often pushing the $5M Reg CF cap) in early 2025 included Eagle Energy Metals ($5.17M on Equifund) and Mivium Resources ($5.05M, Equifund) in March, and Frontieras North America ($3.08M, DealMaker) in January. Tech and consumer companies also drew investors: AI/Web3 platform Arrived raised $2.52M, Film/media ventures like Brave the Dark (Angel Funding) surpassed goals, and food/consumer businesses saw success. For example, March’s top single-raise was Shaky Hands Coffee Shop ($100K goal hit 103%, Honeycomb debt), and April had Yarnhub Animation raising $1.08M (PixMii) and veteran firms like ROI Investment Fund raising $1.12M on CrowdFundMyDeal. By June, leader Legion M (entertainment) raised $1.24M. In general, deals with prior traction, clear branding or mission (or built-in audiences) tended to outperform in this period.

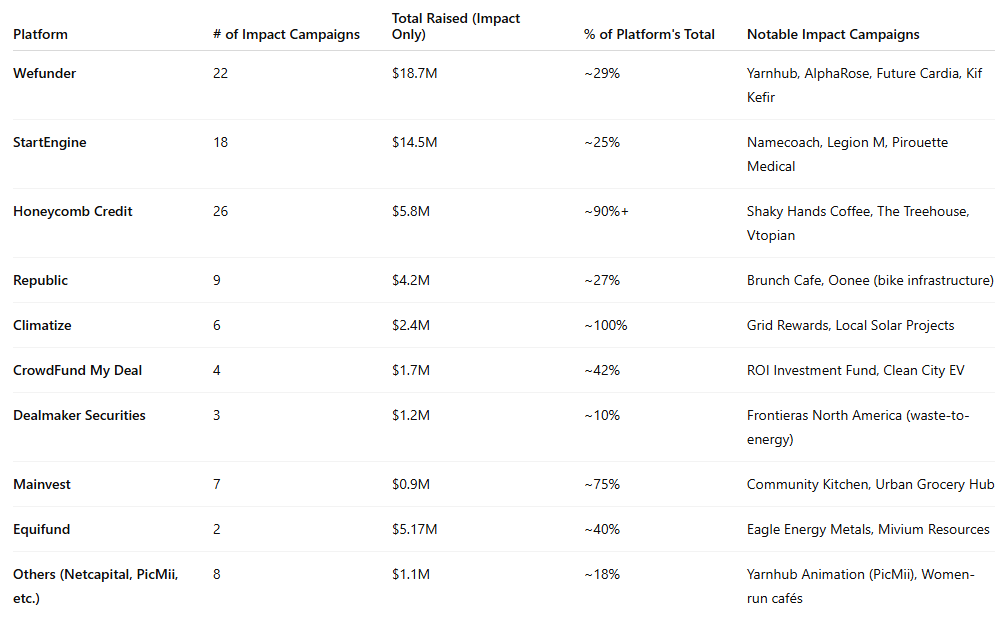

Impact-Focused Reg CF Campaigns by Platform (Jan–Jun 2025)

Highlights:

Honeycomb Credit had the highest concentration of impact campaigns (~90%), funding small local businesses via debt.

Climatize, a clean energy-focused platform, maintained a fully mission-aligned deal pipeline.

Wefunder and StartEngine, while more generalist, hosted several large impact raises.

Equifund's biggest 2025 deals were in domestic energy independence and sustainability.

Sector Trends & Business Types

Investors poured capital into a broad mix of sectors, with a few areas especially prominent. Technology and innovation remained hot: AI and software startups like Namecoach (text-to-speech naming tool) and Moneco (fintech) drew in investors early on, and later Future Cardia (medical device) quickly pivoted to a $2.1M Reg A+ raise after $1.2M Reg CF. Clean energy and resource plays saw large raises – e.g. Eagle Energy Metals (domestic energy minerals) and Mivium (uranium mining) each topped $5M. Healthcare and biotech also performed: AlphaRose Therapeutics raised $1.13M in Feb, and numerous medtech firms (like Pirouette Medical) drew investor interest. “Classic” consumer sectors did well, too. Notably, nearly half of LGBTQ+ founder campaigns were in food, beverage or restaurants. In mainstream raises, companies like Kif Kefir (consumer beverages) and direct-to-consumer brands found support. Entertainment/media also featured, from comic-producer Legion M to YouTube animation studios like Yarnhub. Overall, KingsCrowd observed that fields such as clean energy, tech, and consumer products tended to attract strong raises in 2025, while community-oriented local businesses (food shops, breweries, fitness studios) used debt or revenue-share deals to tap interested retail investors.

Security Types and Investment Structure

By a wide margin, equity offerings dominated 2025 crowdfunding volume. In 2024 overall, equity deals accounted for $303M (88%) of Reg CF volume versus $40M (12%) in debt/revenue-share. This preference remained in early 2025 – most startups raised common stock or convertibles. However, non-equity models have gained some traction for certain niches. For instance, small local businesses often raise via debt on specialized portals: in March, Shaky Hands Coffee (business debt on Honeycomb) and Pie102 (fixed-income on real-estate platform Invown) both hit 100% funding. In February, The Treehouse (a wellness studio) fully funded a debt raise, and even a niche plant-based cheese brand (Vtopian Artisan) raised 65% of its small goal with debt. Meanwhile, SAFE and convertible notes remain popular for tech startups: e.g. the IP-management platform iPNOTE raised 59% of its goal on a SAFE in Feb. KingsCrowd’s data suggests investors still overwhelmingly deploy capital in equity, but many founders (especially those not seeking high valuations) are turning to debt and revenue-share offerings to appeal to community lenders.

Founders & Diversity: Women, Minority, Black, LGBTQ

Reg CF is bringing more diverse founders into fundraising, though gaps remain. In 2024 a record 34% of Reg CF deals had at least one woman founder. (In contrast, only ~9–10% of VC deals involve women-only teams.) However, funding is not yet proportional: teams with a woman founder raised just 26% of Reg CF capital that year. The chart below illustrates how the share of companies with women founders (purple) and without (green) has trended up from 2020 to 2024, reaching a high of 34% in 2024.

Chart: Number of Reg CF offerings with at least one woman founder (purple) vs. without (green), 2020–2024. In 2024 about 34% of new campaigns had a woman on the founding team.

Despite greater representation, women-led startups still receive a smaller slice of the funding pie. In 2024, women-led teams took only ~26% of total capital. (For context, this far exceeds VC’s 1.9% to all-female teams but still highlights room for equity.) The next chart shows the share of capital going to women-led companies (purple) vs. others (green) over time.

Chart: Capital raised by women-led Reg CF teams (purple) vs. others (green). In 2024, women co-founders’ companies attracted about 26% of total crowdfunding dollars.

Minority founders have a similar footprint: in 2024, 34% of new Reg CF deals featured at least one minority founder. These companies raised ~27% of Reg CF capital, indicating the gap between deal representation and funds is smaller than for women. (This 27% also far outpaces the sub-5% of VC dollars going to minority teams.) The chart below shows minority-led offerings (purple) increasing to 34% of deals by 2024.

Chart: Number of Reg CF offerings with at least one minority founder (purple) vs. without (green), 2020–2024. By 2024, roughly 34% of campaigns had minority founders.

Capital to minority teams has likewise grown. In 2024, companies with minority founders raised ~27% of total Reg CF funding. The bar chart below compares that share (purple) to the rest (green).

Chart: Capital raised by minority-led Reg CF teams (purple) vs. others (green), 2020–2024. In 2024, minority-founded companies captured ~27% of the funding.

Within these groups, Black founders are still under-capitalized. KingsCrowd analysis shows 14.6% of all Reg CF deals had a Black founder (12.5% entirely Black-founded) in 2023–24. Yet Black-led teams raised only ~4.4% of crowdfunding capital (5.0% in 2024). This 5% funding share for Black founders is dramatically higher than their roughly 0.3–0.5% share of VC dollars, but it still lags their deal share. The trend is positive: Black founders’ representation climbed from 9.5% of Reg CF deals in 2020 to 11% in 2024.

Data on LGBTQ+ founders is still limited but encouraging. KingsCrowd tracked 99 raises led by self-identified LGBTQ+ founders since late 2021. Nearly half of those (about 49%) were in Food, Beverage & Restaurants, another 18% in Consumer Products and 18% in Media/Entertainment. Niche platforms are popular: Honeycomb hosted ~47% of LGBTQ+ deals, Wefunder ~25%, Republic 10%. (Platforms often tag deals led by LGBTQ+ entrepreneurs to help investors find them.) Overall, crowdfunding appears to be a more inclusive channel: by 2024 both women and minority founders collectively formed 68% of new raises, a trend of increasing diversity that outpaces traditional VC.

Seasonality & Timing (Next 6 Months)

Historically, Reg CF sees its highest activity in spring (around tax season) and slower engagement in mid-summer. January–April 2025 followed this pattern (peak in Mar–Apr), with a post-Easter cooldown. KingsCrowd notes that July and August often bring mixed momentum and lower overall funding, and the data so far confirms June’s decline as more than a blip. While every year has quirks, founders planning raises in Q3 should be aware of potential summer lulls. By contrast, late Q3/Q4 tend to pick up – many issuers launch campaigns in the fall when back-to-school and year-end corporate budgets can revive investor attention.

Given this, our outlook for July–Dec 2025 is cautious but optimistic: we expect total monthly funding to remain modest in July/August (perhaps 20–25% below spring peaks), then rebound in September/October, with another dip in late December. Of course, macro factors (economic shifts, SEC rule changes, interest rates) could sway these trends. Founders should plan around seasonality – e.g. using summer to refine marketing or pre-raise interest, then capitalize on fall investor engagement. Investors should similarly watch the calendar: take advantage of quieter months to do due diligence on new opportunities and be ready for robust deal flow in autumn.

Strategies for Success

For startup founders: Stand out with a strong story, clear traction, and community engagement. KingsCrowd analysis emphasizes that “investor interest remains highly engaged” in well-positioned campaigns, even when overall activity dips. Campaigns with mission-driven models, niche appeal or repeat engagement (e.g. second raises) performed especially well. To succeed, founders should leverage these attributes: highlight any product-market fit or prior sales, engage directly with their personal networks and social media, and use tools like Testing-the-Waters to gauge and build interest before going live (several 2025 raises followed up popular TTW previews). Clear communication is critical: KingsCrowd notes that “ongoing success will depend on managing campaign expectations and investor relations effectively”. That means promptly updating investors on milestones, being realistic about timelines, and showing how any new funds will drive growth. Founders should also choose platforms strategically: match the deal structure to the portal’s user base (e.g. consider Honeycomb for debt funding of small businesses, or crypto-related portals if applicable). Finally, beware of valuation creep: overpricing can stall a raise, so set achievable goals. The most successful 2025 deals combined solid market opportunities with grounded funding targets and active outreach.

For investors: Diversify and do your homework. The Reg CF landscape offers hundreds of deals per quarter, but capital seems to concentrate in fewer campaigns. Use data and platforms (e.g. performance ratings or KingsCrowd’s tools) to find high-quality offerings. Note that well-rated companies generally achieve their goals (in Feb 2025, KingsCrowd’s top-rated deals saw higher funding efficiency). Focus on industries you understand, and consider spreading smaller investments across multiple sectors (tech, consumer, climate, etc.). Keep in mind the seasonal rhythms: some great deals may appear when others hesitate (e.g. under-subscribed summer campaigns). Also consider impact: funding underrepresented founders can both drive returns (these companies often outperform low VC benchmarks) and fulfill mission goals. Overall, patience and selectivity are key – recent reports highlight that investors are moving towards quality over quantity, “seeking high-potential opportunities… where investor conviction is high”. Staying engaged (even between deals), re-investing in breakout companies (like creators or fan-driven brands), and following up on past investments (e.g. supporting second-round raises) can significantly improve outcomes.

In summary, Regulated Crowdfunding in early 2025 has shown robust year-over-year growth, with a broadening array of companies and founders finding capital. The spring “tax-season” surge underscores that, for a well-prepared issuer, crowdfunding can attract multi-million-dollar checks. As we head into the latter half of 2025, market maturity means both investors and founders must double down on fundamentals: clear value propositions, realistic goals, and targeted engagement will separate successful campaigns from the rest. By leveraging the data and trends above, stakeholders on both sides can navigate the coming months effectively and capitalize on this democratized path to startup funding.

Sources: KingsCrowd industry reports and data analysis (Jan–Jun 2025)

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, Rancho Affordable Housing (Proactive), Playper, and Emerald PH. Learn more about advertising with us here.

Max-Impact Members

The following Max-Impact Members provide valuable financial support to keep us operating:

Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | Lory Moore, Lory Moore Law | Marcia Brinton, High Desert Gear | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Ralf Mandt, Next Pitch | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

Impact Cherub Club Meeting hosted by The Super Crowd, Inc., a public benefit corporation, on July 15, 2025, at 1:00 PM Eastern. Each month, the Club meets to review new offerings for investment consideration and to conduct due diligence on previously screened deals. To join the Impact Cherub Club, become an Impact Member of the SuperCrowd.

SuperCrowdHour, July 16, 2025, at 1:00 PM Eastern. Devin Thorpe, CEO and Founder of The Super Crowd, Inc., will lead a session on "Balance Sheets & Beyond: The Impact Investor’s Guide to Financials." If terms like “income statement” and “cash flow” make your eyes glaze over, this session is for you. Devin will break down the fundamentals of financial statements in clear, simple language—perfect for beginners who want to better understand the numbers behind the businesses they support. Whether you're a new investor, a founder navigating financials, or simply curious about how money moves through mission-driven companies, you'll leave this session more confident and informed. Don’t miss it!

SuperCrowd25, August 21st and 22nd: This two-day virtual event is an annual tradition but with big upgrades for 2025! We’ll be streaming live across the web and on TV via e360tv. Apply for the Live Pitch here. VIPs get access to our better-than-in-person networking, including backstage passes, VIP networking and an exclusive VIP webinar! Get your VIP access for just $25. A select group of affordable sponsorship opportunities is still available. Learn more here.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events

Devin Thorpe is featured in a free virtual masterclass series hosted by Irina Portnova titled Break Free, Elevate Your Money Mindset & Call In Overflow, focused on transforming your relationship with money through personal stories and practical insights. June 8-21, 2025.

Join Dorian Dickinson, founder & CEO of FundingHope, for Startup.com’s monthly crowdfunding workshop, where he'll dive into strategies for successfully raising capital through investment crowdfunding. June 24 at noon Eastern.

Future Forward Summit: San Francisco, Wednesday, June 25 · 3:30 - 8:30 pm PDT.

Regulated Investment Crowdfunding Summit 2025, Crowdfunding Professional Association, Washington DC, October 21-22, 2025.

Impact Accelerator Summit is a live in-person event taking place in Austin, Texas, from October 23–25, 2025. This exclusive gathering brings together 100 heart-centered, conscious entrepreneurs generating $1M+ in revenue with 20–30 family offices and venture funds actively seeking to invest in world-changing businesses. Referred by Michael Dash, participants can expect an inspiring, high-impact experience focused on capital connection, growth, and global impact.

Call for community action:

Please show your support for a tax credit for investments made via Regulation Crowdfunding, benefiting both the investors and the small businesses that receive the investments. Learn more here.

If you would like to submit an event for us to share with the 9,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.