U.S. Reg CF in 2026: An Outlook on Smarter Capital, Fewer Campaigns, and a Maturing Market

Regulated Investment Crowdfunding in the United States is entering 2026 in a very different place than where it began.

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

Note to Our Valued Subscribers:

As we celebrate the holiday season, we’re taking a brief pause from our regular posts to share this special article with you. We hope it adds value to your journey and keeps you inspired as the year comes to a close. Wishing you a joyful holiday season and a prosperous New Year filled with opportunities and success! Thank you for being part of our community. 🎉🎄

🎯 Dive into the inspiring stories of successfully funded impact crowdfunding campaigns and discover how they’re driving change! Click the link below to explore.

Note: This article reflects a forward-looking outlook for 2026 based on current U.S. Regulation Crowdfunding data, platform trends, and observed investor behavior. It is not a forecast or financial advice, but an analysis of where the market appears to be heading.

What started as an experimental access point for retail investors has evolved into a more disciplined, selective, and increasingly strategic capital formation channel.

Rather than chasing volume, the Reg CF market is prioritizing quality. Campaign counts are moderating, investor behavior is maturing, and founders are approaching crowdfunding with clearer expectations. These shifts suggest that Reg CF is not contracting—it is professionalizing.

The Big Picture: Maturity Over Momentum

As 2026 begins, U.S. Reg CF activity reflects a clear structural change:

Fewer but stronger campaigns

Larger average raise sizes

More experienced founders

More informed, selective investors

This evolution mirrors what many emerging asset classes experience as they age. The novelty phase fades, weak participants exit, and stronger operators remain. Reg CF appears to be following that exact trajectory.

Investor Selectivity Is Reshaping the Market

One of the most defining forces heading into 2026 is investor behavior.

Retail investors are no longer backing campaigns purely on vision or novelty. Instead, they increasingly prioritize:

Clear use of proceeds

Evidence of traction or early revenue

Founder execution history

Realistic growth and dilution expectations

As a result, campaigns that succeed today tend to be better prepared, better communicated, and better aligned with long-term business fundamentals. For founders, this means that preparation and credibility now matter more than platform reach alone.

Founders Are More Experienced—and More Strategic

Another noticeable trend entering 2026 is who is using Reg CF.

The ecosystem is seeing a rise in:

Second-time founders

Operators with industry or acquisition experience

Small businesses transitioning into scalable venture models

These founders tend to treat Reg CF as part of a broader capital strategy—not a last resort. They communicate more consistently, plan beyond the raise, and understand the long-term relationship they are building with investors.

This shift is quietly improving investor confidence across the entire market.

Funding Portals: Differentiation Is No Longer Optional

By 2026, the gap between funding portals has widened.

The strongest U.S. portals now compete on:

Issuer readiness and screening

Investor education and transparency

Campaign analytics and marketing support

Post-raise compliance and communications

Platforms that function as full-service capital partners are gaining credibility, while listing-only models face increasing pressure. For both founders and investors, portal choice has become a strategic decision rather than a convenience.

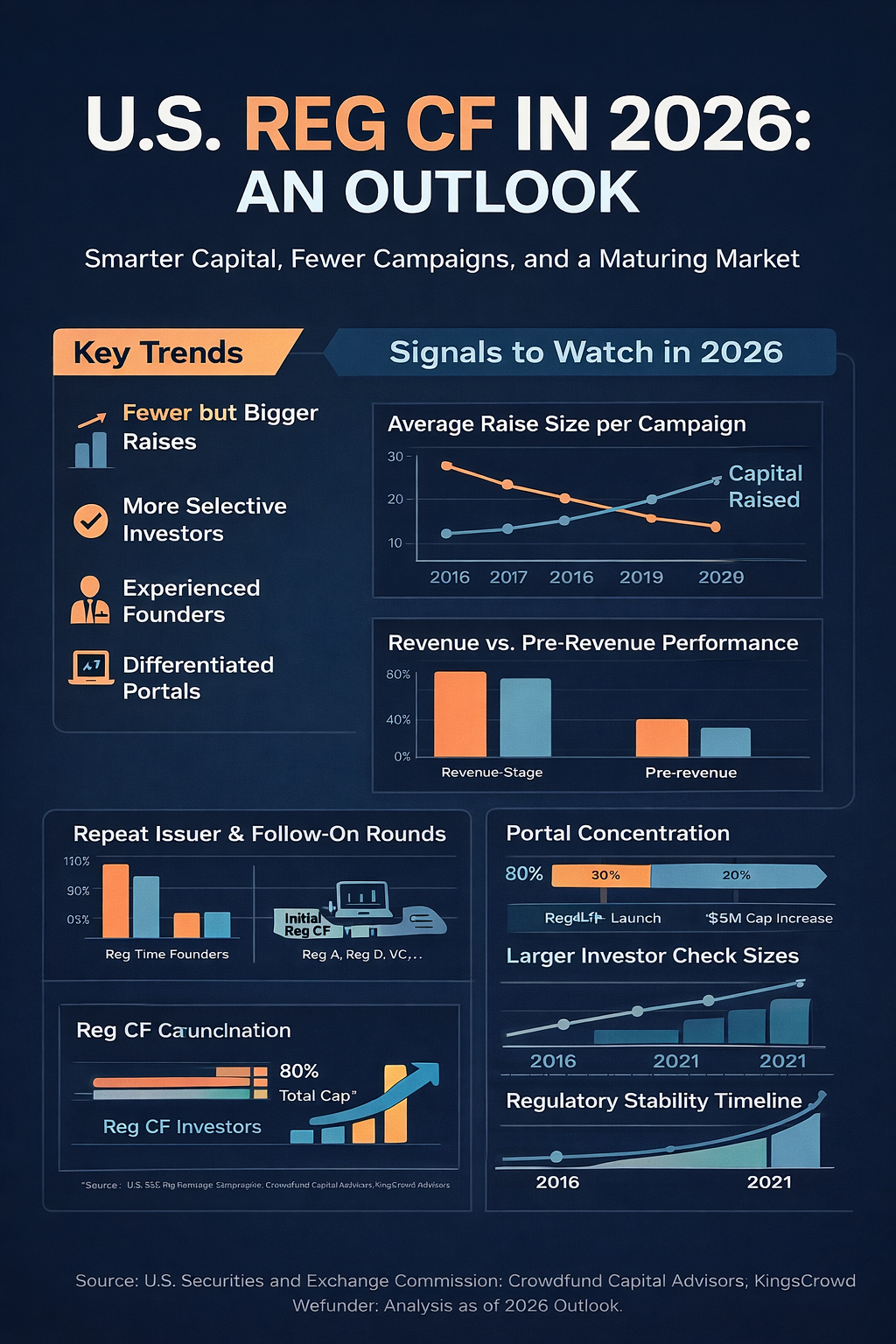

Signals to Watch in 2026

While the direction of Reg CF is becoming clearer, several measurable signals will determine how strong this next phase becomes.

Average Raise Size per Campaign

Rising averages would confirm that capital is concentrating around higher-quality issuers rather than spreading thinly across weaker campaigns.

Speed to Minimum Funding Targets

Campaigns reaching minimum thresholds faster signal better preparation, stronger investor trust, and healthier market momentum.

Repeat Issuers and Follow-On Rounds

An increase in founders returning to Reg CF—or graduating to Reg A, Reg D, or strategic investment—would validate crowdfunding as a repeatable financing pathway.

Portal-Level Concentration

If capital and quality campaigns increasingly flow through a smaller number of trusted portals, it will confirm ongoing industry consolidation and professionalization.

Investor Behavior Shifts

Larger average check sizes, greater diligence, and participation from experienced angels would further strengthen Reg CF’s credibility as an early-stage asset class.

Regulatory Stability

Perhaps the most important signal in 2026 is consistency. A stable regulatory environment allows founders, portals, and investors to plan long-term—an essential ingredient for sustainable growth.

Reg CF as a Bridge, Not the Final Destination

One of the healthiest developments entering 2026 is how founders are positioning Reg CF.

Increasingly, it is used as:

A community-driven validation round

A customer-investor acquisition strategy

A stepping stone to larger exempt offerings or strategic capital

This framing aligns Reg CF with broader capital markets rather than isolating it. When done well, it enhances—not replaces—traditional funding pathways.

Final Thought: Reg CF’s Strongest Years May Still Be Ahead

The story of U.S. Reg CF in 2026 is not about explosive growth or dramatic disruption. It is about refinement.

The ecosystem is becoming:

More disciplined

More transparent

More outcome-oriented

For founders willing to prepare properly, investors willing to think long-term, and platforms committed to quality, Reg CF is evolving into a durable and credible pillar of early-stage capital formation.

The next chapter of crowdfunding may be quieter—but it is also smarter.

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include RISE Robotics, and Crowdfunding Made Simple. Learn more about advertising with us here.

Max-Impact Members

(We’re grateful for every one of these community champions who make this work possible.)

Brian Christie, Brainsy | Cameron Neil, Lend For Good | Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | John Berlet, CORE Tax Deeds, LLC. | Justin Starbird, The Aebli Group | Lory Moore, Lory Moore Law | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Mike Green, Envirosult | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

SuperGreen Live, January 22–24, 2026, livestreaming globally. Organized by Green2Gold and The Super Crowd, Inc., this three-day event will spotlight the intersection of impact crowdfunding, sustainable innovation, and climate solutions. Featuring expert-led panels, interactive workshops, and live pitch sessions, SuperGreen Live brings together entrepreneurs, investors, policymakers, and activists to explore how capital and climate action can work hand in hand. With global livestreaming, VIP networking opportunities, and exclusive content, this event will empower participants to turn bold ideas into real impact. Don’t miss your chance to join tens of thousands of changemakers at the largest virtual sustainability event of the year. Learn more about sponsoring the event here. Interested in speaking? Apply here. Support our work with a tax-deductible donation here.

Demo Day at SuperGreen Live. Apply now to present at the SuperGreen Live Demo Day session on January 22! The application window is closing soon; apply today at 4sc.fun/sgdemo. The Demo Day session is open to innovators in the field of climate solutions and sustainability who are NOT currently raising under Regulation Crowdfunding.

Live Pitch at SuperGreen Live. Apply now to pitch at the SuperGreen Live—Live Pitch on January 23! The application window closes January 5th; apply today at s4g.biz/sgapply. The Live Pitch is open to innovators in the field of climate solutions and sustainability who ARE currently raising under Regulation Crowdfunding.

SuperCrowd Impact Member Networking Session: Impact (and, of course, Max-Impact) Members of the SuperCrowd are invited to a private networking session on January 27th at 1:30 PM ET/10:30 AM PT. Mark your calendar. We’ll send private emails to Impact Members with registration details.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events.

Join UGLY TALK: Women Tech Founders in San Francisco on January 29, 2026, an energizing in-person gathering of 100 women founders focused on funding strategies and discovering SuperCrowd as a powerful alternative for raising capital.

If you would like to submit an event for us to share with the 10,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.

Nice breakdown of where Reg CF stands. The investor selectivity angle is probably the most underappreciated shift happening right now. Ran a small angel round lastyear and saw this firsthand—the questions got way more specific about dilution and actual path to liquidity. It's less about "cool idea" and more about "show me the model." One thing I'd add though is that portal concentration might actually hurt smaller, experimental campaigns that could succeed with the right community backing but don't fit teh polished metrics yet.