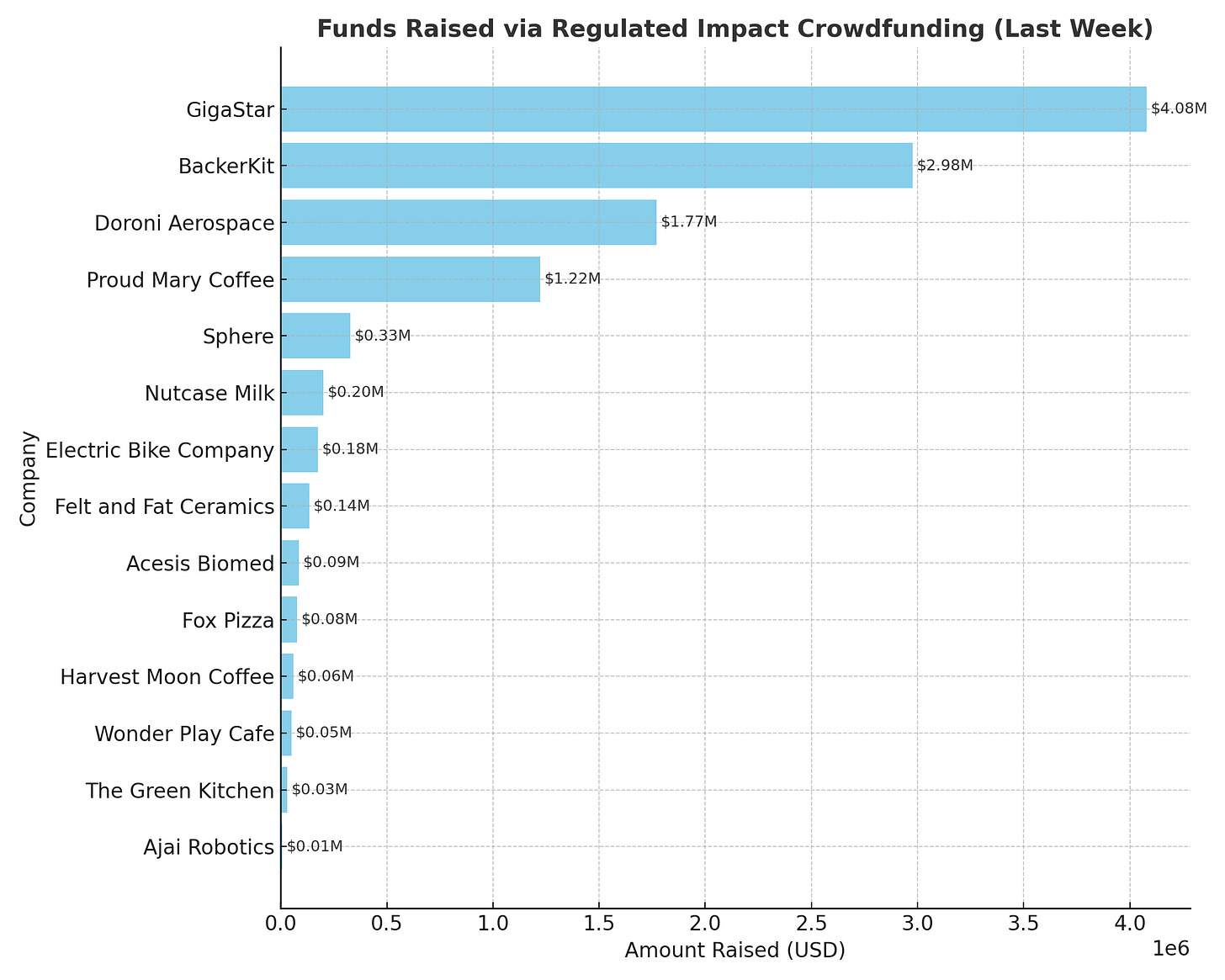

Regulated Impact Crowdfunding Surges: $11.2M Raised Across 14 Campaigns Last Week

14 Campaigns · $11.2M Raised · Diverse Founders · Security Insights · Weekly Analysis of Regulated Impact Crowdfunding Trends

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

Why This Roundup Matters

Each week, the ecosystem of Regulated Impact Crowdfunding produces stories of innovation, diversity, and resilience. Investors across the United States are now backing ventures that range from aerospace startups to local coffee shops, democratizing access to capital while diversifying investment opportunities.

For this analysis, we reviewed funded offerings across platforms like Wefunder, StartEngine, Netcapital, SMBX, Honeycomb Credit, Issuance Express, and Dealmaker Securities.

Our proprietary screening emphasizes:

Impact offerings with measurable social, environmental, or community benefits.

Diversity in leadership, highlighting minority, women, and LGBTQ founders.

Successful campaigns that reached or exceeded their minimum targets.

Variety in security types (Equity, Debt, SAFEs, Convertible Notes).

The result: 14 companies raised $11,202,987 last week. This not only highlights investor enthusiasm but also showcases the breadth of business models and securities shaping the future of Regulated Impact Crowdfunding.

Headline Performers

GigaStar (Wefunder) – $4,080,074 Raised

Valuation: $58M | Security: Equity – Preferred

GigaStar is reshaping how creators fund their growth. By letting investors purchase Channel Revenue Tokens tied to YouTube AdSense income, the platform has built a blockchain-enabled, transparent revenue-sharing system. With 22,000 investor accounts and $680,000 already distributed to investors, GigaStar has proven traction.

This raise is notable for two reasons:

Investor Familiarity: Backers aren’t just funding a company; they’re investing in individual YouTube channels.

Scale: At over $4M raised, GigaStar accounted for more than one-third of last week’s total crowdfunding activity.

BackerKit (Wefunder) – $2,977,948 Raised

Valuation: $89M | Security: SAFE

Known for powering Kickstarter and Indiegogo campaigns, BackerKit provides infrastructure for the creator economy. With $23.7M in revenues in 2024, its traction and Y Combinator backing boosted investor confidence.

BackerKit’s SAFE structure appeals to those seeking early-stage upside. For founders, this security offers flexibility in valuation, which is crucial at growth inflection points.

Doroni Aerospace (StartEngine) – $1,772,016 Raised

Valuation: $209M | Security: Equity – Preferred

Doroni Aerospace captured attention with its eVTOL (electric vertical takeoff and landing aircraft) prototypes, edging closer to the dream of personal flying vehicles. While high-risk and capital-intensive, Doroni embodies the aspirational potential of crowdfunding: giving everyday investors access to technologies that once only venture capitalists could touch.

Proud Mary Coffee (StartEngine) – $1,222,508 Raised

Valuation: $60M | Security: Convertible Note

Coffee lovers helped propel Proud Mary Coffee, already a globally recognized brand with $100M lifetime revenues, to a successful raise. Its convertible note structure provided an approachable entry point for investors, while its strong retail presence and sustainability ethos enhanced its impact profile.

Emerging Innovators

Sphere (Wefunder) – $328,549 Raised

A climate-focused fintech, Sphere offers climate-friendly 401(k) investment options. With 378% year-over-year growth and features in major media outlets, Sphere illustrates how Regulated Impact Crowdfunding can support mission-driven financial products.

Nutcase Milk (Issuance Express) – $200,300 Raised

Founded by Joelle Weinand and Tyler Blevins, Nutcase Milk is a woman-led, plant-based beverage company scaling clean cashew milk across Nevada and Arizona. This raise stands out for diversity and consumer impact.

Electric Bike Company (StartEngine) – $175,543 Raised

With 25,000+ customers and $70M lifetime revenues, Electric Bike Company represents a more mature consumer goods play. Investors are backing sustainability and local U.S. manufacturing in this equity raise.

Felt and Fat Ceramics (Wefunder) – $135,255 Raised

This Philadelphia-based ceramic manufacturer blends artistry with community job creation. Collaborations with Megan Rapinoe, Houseplant, and Danny Meyer’s USHG show strong brand alignment, while the SAFE structure kept the offering founder-friendly.

Acesis Biomed (Netcapital) – $86,104 Raised

Working on non-steroidal testosterone therapy, Acesis Biomed blends biotech innovation with social impact. Its patents and preclinical data provide credibility, though biotech crowdfunding remains speculative and long-term.

Community-Focused Ventures

Fox Pizza (SMBX) – $76,480 Raised

This sourdough pizza pop-up is expanding into a full restaurant. Its debt structure provided investors with defined repayment expectations, while its local impact made it attractive to community lenders.

Harvest Moon Coffee & Chocolates (Honeycomb) – $58,870 Raised

With awards for both coffee and community service, Harvest Moon represents the dual role of small businesses: creating jobs and providing gathering spaces. Its debt raise directly links local investors to community growth.

Wonder Play Cafe (Honeycomb) – $51,072 Raised

A family wellness and play hub, Wonder Play Cafe represents women-led entrepreneurship. The debt model allowed for accessible capital while creating a family-first community business.

The Green Kitchen (Honeycomb) – $30,000 Raised

Founded by Tammy Brawley, The Green Kitchen focuses on plant-forward meals and community culinary education. As a woman-led venture raising through debt, it aligns with both impact and diversity criteria.

Ajai Robotics (Dealmaker Securities) – $8,268 Raised

Though the smallest raise of the week, Ajai Robotics’ mission—using AI-powered robots for school security—taps into urgent societal needs. For investors, it exemplifies how crowdfunding can support early, high-risk ideas that may one day scale dramatically.

Security Type Breakdown

One strength of Regulated Impact Crowdfunding is the diverse financial instruments available. Last week’s raises included:

Equity – Preferred: GigaStar, Doroni Aerospace (large, scalable ventures).

Equity – Common: Electric Bike Company, Acesis Biomed, Ajai Robotics.

SAFE: BackerKit, Sphere, Nutcase Milk, Felt and Fat Ceramics.

Convertible Note: Proud Mary Coffee.

Debt: Fox Pizza, Harvest Moon, Wonder Play Cafe, The Green Kitchen.

Takeaway:

Equity & SAFEs dominated in terms of dollars raised, appealing to high-growth investors.

Debt worked well for local, community-based businesses where repayment can be structured over time.

Convertible Notes offered hybrid benefits for mid-stage growth ventures.

Investor Recommendations

Diversify across security types. Equity offers upside, debt provides steady returns, and SAFEs capture early-stage growth.

Evaluate traction. Revenues, patents, and partnerships can help differentiate serious ventures from speculative ones.

Look for impact. Beyond financials, companies solving real problems (climate, health, food access) are well-positioned for long-term value.

Align with your time horizon. Debt offers quicker liquidity; equity requires patience.

Startup Recommendations

Choose securities strategically. Use SAFEs for early-stage fundraising, equity when you’re ready for growth, and debt for community-focused stability.

Tell your impact story. Diversity and mission resonate with investors seeking meaning alongside returns.

Leverage your community. Local businesses that activate their networks (e.g., coffee shops, cafes) often succeed in debt crowdfunding.

Provide transparency. Frequent updates and clear use-of-funds build trust with retail investors.

The Expanding Frontier of Regulated Impact Crowdfunding

The $11.2M raised across 14 campaigns last week demonstrates how Regulated Impact Crowdfunding is scaling beyond niche. From multi-million-dollar creator platforms to small-town coffee shops, the model is unlocking capital for founders who might otherwise be overlooked.

Equally important, it is broadening who gets to invest—empowering everyday people to back ventures aligned with their values, communities, and financial goals.

As diversity grows—through minority-led ventures, women founders, and LGBTQ-led startups—the industry is proving its role not just as an alternative to venture capital, but as a more inclusive, impact-driven financial system.

The momentum is clear: Regulated Impact Crowdfunding is not just funding businesses; it is reshaping capital markets from the ground up.

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, Rancho Affordable Housing (Proactive), Positive Polar, and Inner Space. Learn more about advertising with us here.

Max-Impact Members

The following Max-Impact Members provide valuable financial support to keep us operating:

Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | Lory Moore, Lory Moore Law | Marcia Brinton, High Desert Gear | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Ralf Mandt, Next Pitch | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

Impact Cherub Club Meeting hosted by The Super Crowd, Inc., a public benefit corporation, on September 16, 2025, at 1:30 PM Eastern. Each month, the Club meets to review new offerings for investment consideration and to conduct due diligence on previously screened deals. To join the Impact Cherub Club, become an Impact Member of the SuperCrowd.

SuperCrowdHour, September 17, 2025, at 12:00 PM Eastern. Devin Thorpe, CEO and Founder of The Super Crowd, Inc., will lead a session on "What's the Difference Between Gambling and Investing? Diversification." When it comes to money, too many people confuse speculation with true investing. In this session, Devin will explore what separates gambling from responsible investment practices—and why diversification is one of the most important tools for reducing risk and improving outcomes. Drawing on real-world examples and practical strategies, he’ll help you understand how to evaluate opportunities, spread risk wisely, and think long-term about your portfolio. Whether you’re new to investing, considering your first community round, or looking to refine your approach as a seasoned investor, this SuperCrowdHour will give you actionable insights to strengthen your decision-making. Don’t miss this chance to sharpen your perspective and invest with greater confidence.

Superpowers for Good Live Pitch, September 29, 2025. Hosted by Devin Thorpe on e360tv, this special event gives purpose-driven founders the chance to pitch their active Regulation Crowdfunding campaigns to a nationwide audience of investors and supporters. Selected founders will gain exposure to investors, national visibility across social and streaming platforms, and exclusive prizes from judges and sponsors—all at no cost to apply or pitch.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events.

Earthstock Festival & Summit (Oct 2–5, 2025, Santa Monica & Venice, CA) unites music, arts, ecology, health, and green innovation for four days of learning, networking, and celebration. Register now at EarthstockFestival.com.

Regulated Investment Crowdfunding Summit 2025, Crowdfunding Professional Association, Washington DC, October 21-22, 2025.

Impact Accelerator Summit is a live in-person event taking place in Austin, Texas, from October 23–25, 2025. This exclusive gathering brings together 100 heart-centered, conscious entrepreneurs generating $1M+ in revenue with 20–30 family offices and venture funds actively seeking to invest in world-changing businesses. Referred by Michael Dash, participants can expect an inspiring, high-impact experience focused on capital connection, growth, and global impact.

If you would like to submit an event for us to share with the 9,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.