From Skin to Wind: How Impact Crowdfunding Backed Radical Tech in Health and Renewables

Two campaigns, distinct domains — an AI-powered full-body skin scanner and urban wind turbines — illustrate how RegCF capital is shaping high-tech impact in 2025

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

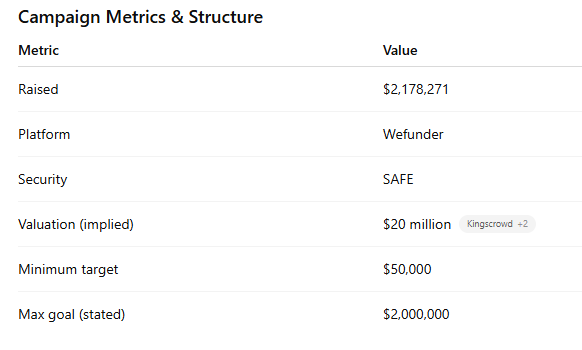

In a fundraising environment crowded with buzz and noise, two offerings stood out last week in the regulated impact crowdfunding space — SkinBit and Flower Turbines Project Series 1. Together, they raised $2,178,271 + $744,000 = $2,922,271 from retail investors, signaling that investors continue to place bold bets on mission-driven technologies.

These campaigns highlight two compelling domains:

Healthtech / AI diagnostics (SkinBit)

Clean energy / distributed infrastructure (Flower Turbines)

By examining their strategies, metrics, domain-specific complexity, and investor appeal, we gain insight into what makes certain impact campaigns succeed — and what lessons founders and investors can carry forward into the rest of 2025.

In what follows, we’ll:

Walk through each campaign in depth

Compare and contrast their business models, risks, and value propositions

Provide data visualizations (in text) to make the comparisons crisp

Offer tactical advice for founders and investors

Predict how Regulated Impact Crowdfunding might evolve in the next 12–18 months

Let’s dive in.

SkinBit: Full-Body AI Scanner for Skin Cancer Detection

Overview & Value Proposition

SkinBit’s offering is bold: a whole-body AI scanning system (branded “Sentinel”) that aims to detect skin cancer and suspicious skin conditions quickly, non-invasively, and more accurately than human examiners. According to its campaign:

The target accuracy is 95%, compared to ~75% for many traditional dermatological exams. Wefunder+1

The scan is to be done in 60 seconds, capturing high-resolution images of the entire skin surface. SKINBIT+2SKINBIT+2

The company is positioning its offering at consumer-accessible sites (e.g., med spas, imaging clinics) to democratize access to skin health. SKINBIT+1

Its pitch is this: skin cancer is among the most treatable cancers when caught early. But a lot of people never get screened. By making full-body scanning fast, accessible, and AI-assisted, SkinBit attempts to close that gap.

Notably, the campaign oversubscribed well beyond its minimum. The SAFE structure indicates that early investors get rights to convert into equity under certain conditions (future priced round), rather than direct equity now — a common tactic in early-stage, high-risk tech ventures.

Technical & Market Context

The idea of full-body, 3D imaging for lesions is not unique. An academic prototype called 3DSkin-mapper was introduced in 2022, which uses multiple synchronized cameras in a cylindrical rig to reconstruct and analyze skin lesion changes over time. arXiv

SkinBit’s differentiator lies in scaling that into a consumer / clinic product — faster, user-friendly, AI-integrated, and FDA / regulatory ready.

Challenges in this domain include:

Clinical validation and regulatory clearance: To move from lab to clinic requires rigorous trials, IRB approvals, possibly FDA class II/III device pathways (or equivalent in other jurisdictions).

False positives / negatives risks: AI models must be robust across different skin types, lighting, demographics, and lesion types.

Data privacy & liability: Imaging medical data, cross-border compliance, and protecting patients’ privacy are real concerns.

Adoption & reimbursement: Clinics, dermatologists, insurers may resist new diagnostic modalities until proven cost-effectiveness and reimbursement models exist.

SkinBit aims to tackle these issues using a phased rollout: deploying in controlled partner clinics and med spas, building legitimacy, collecting outcomes data, and then scaling to more consumer-accessible settings. Its crowdfunding raise likely helps fund pilot deployments, regulatory groundwork, and initial marketing/clinic partnerships.

Investor Appeal & Risks

Appeals:

Large addressable market (skin cancer screening, diagnostics).

High margin potential once model is validated (AI diagnostics + subscription / service model).

First-mover / platform effect.

Strong narrative: “democratizing early cancer detection.”

Risks:

Execution risk: building reliable hardware + AI + regulatory compliance.

Capital intensity: prototypes, manufacturing, clinical trials cost money.

Competition risk: other healthtech and imaging AI firms.

Timing risk: delays in regulatory approval can stall growth.

Flower Turbines Project Series 1: Bringing Wind Power to Cities

Overview & Value Proposition

Flower Turbines’ mission is to miniaturize and cluster wind generation in environments where traditional large turbines cannot exist — rooftops, urban settings, or commercial sites. Its campaign is not just equity in a company but direct investment in project-level turbines via a series LLC structure.

Key features:

Over 30 patents across multiple countries. rallyonmedia.com+4Flower Turbines

Recognitions: U.S. DOE, Solar Impulse Foundation, Dutch Ministry of Climate Change, World Economic Forum.

Unique “bouquet effect” or cluster effect: turbines perform better when grouped together in certain configurations, enhancing per-unit efficiency. Flower Turbines

Campaign’s stated plan: deploy turbines in multiple U.S. cities (Bayonne NJ, Brooklyn NY, Springfield IL, etc.). Flower Turbines

As described in its investment promotion: investors receive dividends from project revenues, plus value from tax credits, carbon offsets, and possible capital gains. Flower Turbines+2Kingscrowd+2

Though not a pure debt instrument, the offering is structured like project equity: investors fund specific turbine installations (via an LLC), and returns are tied to that asset’s power generation, contracts, and incentives.

Technical & Market Context

Wind energy has matured, but small-scale urban turbines historically struggled with turbulence, low airflow, aesthetic, and noise constraints. Flower’s vertical-axis, quiet, bird-friendly design aims to overcome these.

The cluster or bouquet effect is a technical innovation: by placing turbines in close geometric patterns, each turbine enhances overall flow and performance, countering losses that typically come from interference.

Their patent portfolio and institutional recognition aim to insulate against competing turbine startups.

Challenges include:

Site-specific constraints: permitting, structural support, wind variability.

Long ramp times: energy projects take months or years to commission.

Revenue risk: contracted off-takers, stability of power purchase agreements (PPAs), maintenance costs.

Subsidy dependency: many renewable projects rely on tax credits or incentives which may phase out. In fact, Flower promotes that investors act before tax incentives expire (e.g. U.S. ITC) Flower Turbines

Investor Appeal & Risks

Appeals:

Tangible assets and infrastructure backing the investment (not just speculative equity).

Recurring cash flow from energy sales + tax credits.

Impact alignment: renewable energy, decarbonization.

Innovation edge via proprietary cluster effect and patents.

Risks:

Execution and permitting delays.

Performance variance: wind resource may be inconsistent.

Maintenance, reliability and warranty risks.

Policy risk: removal or reduction of renewable incentives or tariffs.

Flower Turbines Project Series 1 recently gained national attention after being featured on the Superpowers for Good show—an influential platform spotlighting entrepreneurs using business as a force for good. During the segment, founder Dr. Daniel Farb discussed how Flower Turbines’ patented micro-wind technology can transform clean energy generation in urban environments. The appearance amplified visibility among impact investors and sustainability advocates, highlighting the project’s community-scale wind farms as both profitable and planet-positive.

The campaign was also recognized as one of the “Impact Offerings of the Week”, underscoring its alignment with the growing movement toward distributed renewable energy solutions. The feature showcased real installation footage, technical prototypes, and investor enthusiasm that helped propel the offering to exceed its minimum funding target more than threefold.

🎥 Watch the interview:

Deeper Insights & Lessons

1. Impact Crowdfunding for Deep Tech Is Getting Real

SkinBit’s large raise shows appetite for high-risk, high-impact healthtech. Retail investors are no longer limited to consumer brands or local businesses—they’re participating in advanced medical device development.

2. Project-Based Investment Blurs Traditional Lines

Flower Turbines is not just selling “equity in a company” but direct infrastructure projects. That hybrid approach appeals to investors wanting both impact and physical asset-backed returns.

3. Story & Validation Matter

SkinBit used webinars and public demos (e.g. “Revolutionizing Skin Cancer Detection” webinar) to build legitimacy. SKINBIT Flower Turbines leans on awards, patents, and institutional recognition (DOE, WEF) to bolster credibility.

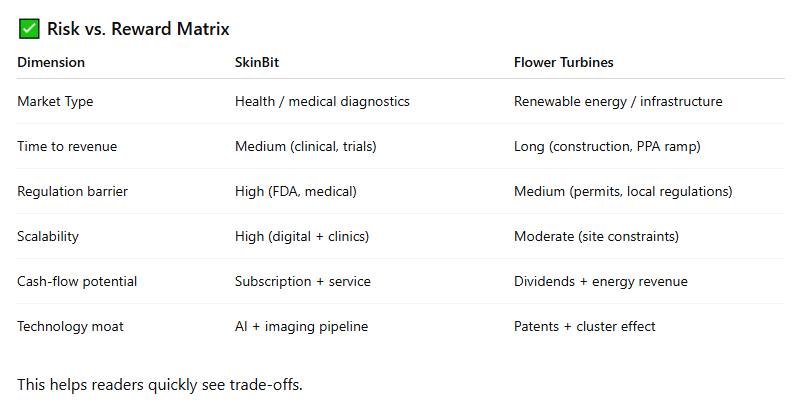

4. Nuanced Risk Structures

The choice of SAFE vs Equity / Project Equity is intentional:

SAFE allows early investors a future equity stake without immediate valuation risk (SkinBit).

Project equity ties investor returns to tangible output (Flower Turbines), better suited for infrastructure and energy assets.

5. Importance of IP & Tech Differentiation

Both companies lean heavily on patents: SkinBit with imaging + AI, Flower with cluster-effect turbine designs. IP serves as a barrier and a signal to investors.

Advice for Founders & Investors

For Founders

Demonstrate traction early: pilot studies, partner clinics, energy contracts help convert skepticism into trust.

Align structure with domain: early healthtech may lean SAFE; energy projects may require asset-backed equity or project LLCs.

Craft your narrative: weave the impact story (health, carbon, accessibility), but back it with technical realism.

Build regulatory & operational scaffolding early: if you delay permits or trials until after the raise, you risk losing momentum.

Segment rollout: start in limited geographies or product lines to learn, then scale.

For Investors

Read the offering docs deeply: Understand conversion terms (for SAFE), dividend mechanics, priority liquidation, and asset separation.

Evaluate team + domain acumen: in deep tech, the team’s background often predicts success more than short-term revenue.

Stress-test assumptions: run downside scenarios — what if regulatory delay happens? What if wind is underperforming?

Diversify across domains & structures: don’t concentrate all bets in one technology class or security type.

Think long-term: these are illiquid, capital-intensive bets. Be patient and focused on impact + sustainable returns.

Predictions & Trends in Regulated Impact Crowdfunding

Healthtech will dominate the next wave

As AI, imaging, and diagnostics improve, more campaigns will emerge in early disease detection, mental health, chronic conditions.More infrastructure & decentralized projects

Expect more offerings like Flower Turbines — community solar, microgrid, water systems — where investors own project-level assets.Blended securities models

Founders will combine SAFEs, equity, revenue-share debt, or tokenized instruments to meet both early-stage flexibility and later-stage investor needs.Regulatory clarity & secondary markets

As more campaigns mature, platforms will push for secondary trading and clearer SEC frameworks to improve liquidity.Stronger due diligence signals

Investors will demand third-party validations, data audits, and transparency on underlying performance.International cross-border offers (with caution)

As platforms globalize, expect more climate and health campaigns from different geographies, though regulatory hurdles remain high.

Last week’s two campaigns — SkinBit and Flower Turbines Project Series 1 — showcase the frontier of impact crowdfunding. One breathes new life into early cancer detection through AI; the other brings wind power to urban settings via clever cluster design. Though distinct in domain, they share core themes: high ambition, intellectual property, asset-backed logic, and the desire to align purpose with profit.

For founders, they serve as blueprint cases of how to balance technology, impact, and investor trust. For investors, they demonstrate how carefully selected impact campaigns can combine innovation and potential financial returns — if you dig past the pitch and understand the structure.

Regulated Impact Crowdfunding has matured beyond simple consumer plays: it’s now powering advanced medical devices and clean energy infrastructure. As you evaluate opportunities ahead, keep your lens wide — and let impact metrics carry as much weight as financial ones.

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, Rancho Affordable Housing (Proactive), and SoHo MD. Learn more about advertising with us here.

Max-Impact Members

The following Max-Impact Members provide valuable financial support to keep us operating:

Brian Christie, Brainsy | Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | John Berlet, CORE Tax Deeds, LLC. | Lory Moore, Lory Moore Law | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

SuperCrowdHour, October 15, 2025, at 12:00 PM Eastern. Devin Thorpe, CEO and Founder of The Super Crowd, Inc., will lead a session on “The Perfect Pitch: Creating an Irresistible Offering.” As a former investment banker and author, Devin will guide entrepreneurs through the process of crafting a regulated investment crowdfunding offering that aligns with investor expectations and captures attention. In this session, he’ll share what makes a pitch compelling, how to structure terms that attract capital, and practical strategies for presenting your company’s story in a way that resonates with investors. Whether you’re launching your first community raise or refining a current campaign, this SuperCrowdHour will equip you with the tools to stand out and secure investor support. Don’t miss this opportunity to learn how to transform your vision into a pitch investors can’t resist.

Impact Cherub Club Meeting hosted by The Super Crowd, Inc., a public benefit corporation, on October 28, 2025, at 1:30 PM Eastern. Each month, the Club meets to review new offerings for investment consideration and to conduct due diligence on previously screened deals. To join the Impact Cherub Club, become an Impact Member of the SuperCrowd.

SuperGreen Live, January 22–24, 2026, livestreaming globally. Organized by Green2Gold and The Super Crowd, Inc., this three-day event will spotlight the intersection of impact crowdfunding, sustainable innovation, and climate solutions. Featuring expert-led panels, interactive workshops, and live pitch sessions, SuperGreen Live brings together entrepreneurs, investors, policymakers, and activists to explore how capital and climate action can work hand in hand. With global livestreaming, VIP networking opportunities, and exclusive content, this event will empower participants to turn bold ideas into real impact. Don’t miss your chance to join tens of thousands of changemakers at the largest virtual sustainability event of the year.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events.

Regulated Investment Crowdfunding Summit 2025, Crowdfunding Professional Association, Washington DC, October 21-22, 2025.

Impact Accelerator Summit is a live in-person event taking place in Austin, Texas, from October 23–25, 2025. This exclusive gathering brings together 100 heart-centered, conscious entrepreneurs generating $1M+ in revenue with 20–30 family offices and venture funds actively seeking to invest in world-changing businesses. Referred by Michael Dash, participants can expect an inspiring, high-impact experience focused on capital connection, growth, and global impact.

If you would like to submit an event for us to share with the 10,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.