$6.52 Million Raised Last Week Through Regulated Impact Crowdfunding: Innovation, Inclusion, and Investor Confidence in Action

From AI breakthroughs and sustainable cookies to Africa’s first anime epic, impact-driven founders raised $6.5M through Regulated Impact Crowdfunding — redefining how capital meets conscience.

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

Introduction: The Expanding Horizon of Regulated Impact Crowdfunding

The momentum of Regulated Impact Crowdfunding continues to grow — and last week was a powerful example of how this model is democratizing access to capital while empowering diverse founders to build ventures that make a real difference.

In total, $6,516,206 was raised across multiple platforms including StartEngine, Wefunder, Vicinity, and Honeycomb Credit. These offerings weren’t just about business growth — they reflected the rise of inclusive, values-aligned entrepreneurship. The week’s highlights included innovations in data compression, AI robotics, hospitality, entertainment, and food manufacturing, with founders representing minority, women, and mission-driven leadership.

At our firm, we use a proprietary analysis to identify impact offerings — those aligned with positive social or environmental goals, inclusive ownership, and sustainable business models. These include:

Offerings led by minority founders

Companies with women or LGBTQ+ leadership

Businesses contributing to community empowerment or sustainability

This approach allows us to track how Regulated Impact Crowdfunding — enabled under Reg CF and Reg A+ exemptions of the JOBS Act — serves as a true catalyst for impact and inclusion.

Why Regulated Impact Crowdfunding Matters

Before diving into the week’s standout deals, it’s worth understanding why Regulated Impact Crowdfunding is transforming startup finance.

Unlike traditional venture capital or private equity, Reg CF and Reg A+ allow everyday investors — not just accredited ones — to participate in early-stage funding rounds. These offerings are reviewed by the SEC (Securities and Exchange Commission) and hosted on regulated portals, ensuring investor protection and transparency.

This democratization of investment serves multiple impact goals:

Financial Inclusion: Allowing the public to invest in startups that reflect their values.

Diverse Founders: Expanding access to capital beyond Silicon Valley networks.

Community Wealth Building: Empowering local and mission-driven enterprises.

Transparency and Accountability: Campaigns are publicly disclosed and regulated.

The results speak for themselves — and this week’s $6.5M raise is a testament to that impact in action.

How We Identify Impact Offerings

Our analysis focuses on several layers of criteria, combining quantitative data (funding targets, valuations, platforms) with qualitative assessment (founder backgrounds, mission statements, and community outcomes). We identify “impact” offerings through four primary lenses:

Foundational Inclusion: Ventures led by women, minorities, or LGBTQ+ founders.

Sustainability and Innovation: Businesses that address environmental or social challenges.

Community Development: Offerings that create local economic resilience.

Ethical and Transparent Growth Models: Preference for companies prioritizing responsible innovation.

Each week, we examine campaigns funded under Reg CF and Reg A+ across leading platforms, filtering for transparency, mission alignment, and investor potential.

Weekly Highlights: The $6.52M Impact Portfolio

Let’s explore each offering that contributed to this remarkable total.

1. AtomBeam – The Next Revolution in Data Compression

Platform: StartEngine

Security Type: Equity – Common

Total Raised: $4,949,485

Valuation: $319.54 million

AtomBeam is redefining how digital data is transmitted, compressed, and secured. With its patented Compaction™ technology, the company reduces IoT data sizes by up to 75%, enhancing speed and security across connected systems.

This isn’t just a tech upgrade — it’s a paradigm shift for the future of the Internet of Things (IoT). The software integrates machine learning algorithms to “restructure” data at the bit level, optimizing efficiency up to 4.4 times faster than conventional compression.

The company’s ecosystem includes partnerships with Nvidia, Intel, and Hewlett-Packard, alongside distribution agreements with Ubiquitous AI — demonstrating both credibility and scalability.

Impact Angle

AtomBeam represents impact through technological efficiency and data sustainability. With IoT devices consuming massive energy and bandwidth, more efficient transmission directly reduces digital carbon footprints — an often-overlooked area of sustainability.

Security Type Insight: Equity - Common

Investors received common equity, meaning they hold ownership shares similar to founders and early employees. This structure is ideal for those seeking long-term value creation rather than short-term liquidity.

Investor Takeaway

For investors, AtomBeam shows that impact doesn’t always mean solar panels or nonprofits — it can mean smarter, leaner technology that benefits industries and the environment alike.

2. Yummy Future – The Robotics-Driven Kitchen Revolution

Platform: Wefunder

Security Type: SAFE (Simple Agreement for Future Equity)

Total Raised: $1,043,951

Valuation: $66.7 million

Yummy Future blends AI, robotics, and hospitality to redefine the future of food service. Their fully automated coffee and food stations allow robots to take on labor-intensive tasks, reducing human fatigue and increasing efficiency.

Founded by Guangzhe Jack Cui and Yueming Garrett Yan, the startup combines AI precision with human creativity, aiming to achieve profitability by 2025.

Yummy Future currently operates two robotic café locations, with a third opening soon — a clear signal of momentum.

Impact Angle

Automation can sometimes be viewed as replacing jobs, but Yummy Future frames it differently — as a tool for human sustainability. By reducing burnout in food service, it enables workers to focus on creative and customer-focused roles. This approach highlights technology as an enabler of dignity and innovation.

Security Type Insight: SAFE

A SAFE (Simple Agreement for Future Equity) is popular in early-stage crowdfunding because it allows investors to benefit from future valuation increases without immediate equity dilution. It’s high-risk but potentially high-reward.

Investor Takeaway

For those seeking futuristic ventures that balance tech advancement with human well-being, Yummy Future offers an intriguing blend of automation, ethics, and market readiness.

3. Waters Edge Winery – Community, Craft, and Connection

Platform: Vicinity

Security Type: Equity – Preferred

Total Raised: $304,100

Valuation: $2.8 million

Waters Edge Winery in Norfolk, Virginia, is more than a business — it’s a community hub where culture and craftsmanship meet. Founders Dyan and Jason Witt bring global grapes to local glasses, crafting small-batch wines that celebrate place and people.

The company’s business model allows for scalability while staying rooted in locality — sourcing crushed grapes from California, Italy, and Armenia, and fermenting them onsite.

Impact Angle

As a woman-led enterprise in a traditionally male-dominated industry, Waters Edge Winery embodies gender diversity and community regeneration. The founders’ focus on inclusivity, local hiring, and sustainable operations creates ripple effects across the hospitality sector.

Security Type Insight: Equity – Preferred

Preferred equity offers investors potential dividends and liquidation preferences — a more protected class compared to common stock. It’s a balanced approach for those seeking income stability and long-term growth.

Investor Takeaway

For investors who appreciate tangible, community-rooted businesses, Waters Edge Winery combines craftsmanship, diversity, and scalability in one bottle.

4. Magic Passport Limited – Bringing African Stories to Global Screens

Platform: Wefunder

Security Type: Revenue Share

Total Raised: $178,670

Africa’s creative economy is booming, and Magic Passport Limited is at the frontier. Their project, The Passport of Mallam Ilia, is an anime-style adaptation of Cyprian Ekwensi’s beloved African novel.

Founder Ferdinand Ladi Adimefe envisions a future where African art meets global audiences. The film is already 75% complete, blending regional music, voice talent, and cultural storytelling into a globally competitive animation.

Impact Angle

Cultural representation is a vital dimension of impact. Magic Passport is not just producing entertainment — it’s reclaiming narratives and giving voice to underrepresented cultures through artistic and economic empowerment.

Security Type Insight: Revenue Share

This model allows investors to earn returns directly from a share of the company’s revenue rather than waiting for an exit. It’s ideal for film and entertainment projects with defined sales cycles.

Investor Takeaway

Investors looking for diversity in both impact and portfolio composition can find value in supporting the rise of African animation, where storytelling meets equity.

5. Daddy’s Dough Cookies – Sweetness with a Social Conscience

Platform: Honeycomb Credit

Security Type: Debt

Total Raised: $40,000

Sometimes impact comes in the form of comfort and community — and that’s exactly what Daddy’s Dough Cookies delivers. Founded by MarcQus Wright in Michigan, this premium cookie company has earned loyal fans across the state for its handcrafted recipes and heartfelt story.

Beyond baking, Daddy’s Dough is about local empowerment — hiring within the community, sourcing locally when possible, and reinvesting in people. The business has been featured on FOX 17 and WZZM 13, showcasing the power of small business storytelling.

Impact Angle

This is grassroots economic impact — entrepreneurship that builds jobs, skills, and pride in place.

Security Type Insight: Debt

Investors receive fixed returns over time. It’s a straightforward model with lower risk than equity and is ideal for community investors seeking both stability and social impact.

Investor Takeaway

For those who believe in local, small-scale resilience, Daddy’s Dough Cookies is the kind of enterprise that reminds us impact can taste sweet.

Understanding Security Types in Regulated Impact Crowdfunding

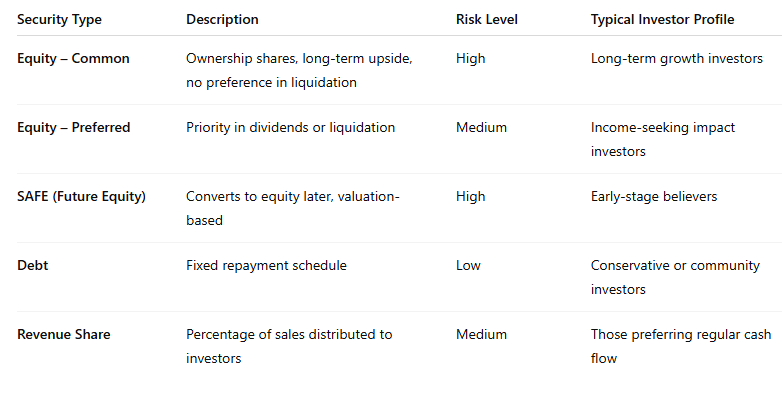

Each security type offers different risk-return dynamics. Here’s a quick breakdown for new investors:

Recommendations for Investors

Diversify Across Sectors: Mix tech, food, clean energy, and creative industries.

Review the Founder Story: Impact investing is as much about people as numbers.

Understand Security Types: Match your risk appetite with the right structure.

Check Community Alignment: Support campaigns that resonate with your values.

Monitor Updates Post-Campaign: Transparency builds trust and accountability.

Recommendations for Startups

Lead with Impact: Investors respond to clear, authentic purpose.

Choose the Right Platform: Each portal has a distinct investor base and sector focus.

Educate Your Investors: Transparent updates and storytelling strengthen engagement.

Highlight Founder Diversity: Representation attracts community-backed capital.

Plan for Post-Raise Growth: Use funds strategically to scale impact, not just operations.

Regulated Impact Crowdfunding Is More Than Finance — It’s Movement

Last week’s $6.52 million in successful raises across five companies proves one thing: impact and innovation are converging through democratized finance. Whether it’s data compression, 3D-printed housing, AI kitchens, African cinema, or artisan cookies, Regulated Impact Crowdfunding is not just fueling business — it’s shaping culture.

These campaigns demonstrate that ordinary investors can now help fund extraordinary ideas — and in doing so, accelerate the transition toward a more inclusive, sustainable economy.

As the ecosystem matures, platforms like StartEngine, Wefunder, Vicinity, and Honeycomb Credit are becoming bridges between capital and conscience, showing us what the future of finance truly looks like: accessible, ethical, and deeply human.

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, Envirosult and Honeycomb Credit. Learn more about advertising with us here.

Max-Impact Members

(We’re grateful for every one of these community champions who make this work possible.)

Brian Christie, Brainsy | Cameron Neil, Lend For Good | Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | John Berlet, CORE Tax Deeds, LLC. | Lory Moore, Lory Moore Law | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

Superpowers for Good Live Pitch applications due by November 17. Apply to pitch at the Superpowers for Good live event on December 11, 2025. This is your chance to spark campaign momentum and present to expert investors who frequently invest in our winners. Applicants must have an active Regulation Crowdfunding offering live when applying that will still be live on the event date. Apply by November 17, 2025.

SuperCrowdHour, November 19, 2025, at 12:00 PM Eastern — Devin Thorpe, CEO and Founder of The Super Crowd, Inc., will lead a session on “Investing with a Self-Directed IRA.” In this session, Devin will explain how investors can use self-directed IRAs to participate in regulated investment crowdfunding while managing taxes and optimizing returns. He’ll break down when this strategy makes sense, how to choose the right custodian, and what fees, rules, and risks to watch for. With his trademark clarity and real-world experience, Devin will help you understand how to balance simplicity with smart tax planning—so you can invest confidently, align your portfolio with your values, and make your money work harder for both impact and income.

SuperGreen Live, January 22–24, 2026, livestreaming globally. Organized by Green2Gold and The Super Crowd, Inc., this three-day event will spotlight the intersection of impact crowdfunding, sustainable innovation, and climate solutions. Featuring expert-led panels, interactive workshops, and live pitch sessions, SuperGreen Live brings together entrepreneurs, investors, policymakers, and activists to explore how capital and climate action can work hand in hand. With global livestreaming, VIP networking opportunities, and exclusive content, this event will empower participants to turn bold ideas into real impact. Don’t miss your chance to join tens of thousands of changemakers at the largest virtual sustainability event of the year.

Community Event Calendar

If you would like to submit an event for us to share with the 10,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.

Regarding the topic of the article, it’s realy insightful how impact crowdfunding democratizes access. I'm keen to see how AI can scale this even further.