$4.23M Raised: What 14 Funded Startups Teach Us About Regulated Investment Crowdfunding

Insights from 14 Diverse Campaigns That Raised Over $4.2M Through Regulated Investment Crowdfunding—What Startups and Everyday Investors Need to Know.

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

Every Sunday, we bring you a roundup of the most successful impact crowdfunding campaigns that have achieved their funding goals. Join us to celebrate the impact and innovation that these ventures have brought to life. To make sure you never miss an update, move our emails to your Primary inbox in Gmail or mark them as 'Not Spam' in other email services.

As more startups and small businesses explore alternative paths to raise capital, regulated investment crowdfunding (RIC) has emerged as a potent and increasingly mainstream financing tool. In this article, we explore a diverse group of 14 successfully funded campaigns, which collectively raised $4,229,951, and uncover what founders and investors alike can learn from their stories.

These campaigns used a mix of security types—equity, debt, SAFEs, and revenue share—across multiple regulated platforms such as Wefunder, StartEngine, Honeycomb Credit, SMBX, PicMii, and Main Street Bond. From chocolate makers to EV innovators, these founders turned their vision into funded reality using the power of the crowd.

Let’s break it down.

What Is Regulated Investment Crowdfunding (RIC)?

Regulated investment crowdfunding refers to the process where startups raise capital from the public under SEC regulations (Reg CF and Reg A+), enabling both accredited and non-accredited investors to invest in early-stage and growth-stage businesses.

Since its 2016 debut, Reg CF has enabled thousands of companies to raise up to $5 million per year through online platforms registered with FINRA and the SEC. Unlike donation or reward-based crowdfunding, investors actually own equity, receive debt repayments, or share in future revenue.

Platform Diversity: Why the Portal You Choose Matters

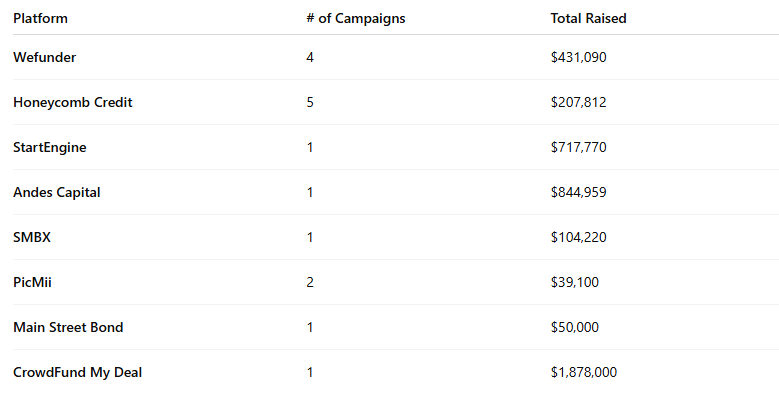

These 14 companies raised funds on eight different crowdfunding platforms, each catering to specific types of businesses and investor appetites:

Takeaway for startups: Choose your platform wisely. Real estate funds gravitate toward CrowdFund My Deal, food and beverage brands favor Honeycomb, and scalable tech or consumer brands often go with Wefunder or StartEngine. Some platforms like PicMii focus on smaller, more community-driven campaigns.

Security Types: What’s Being Sold?

Regulated crowdfunding offers various security types. Here's how the 14 deals break down:

Observation: Equity still dominates, especially for tech and scalable startups. However, debt crowdfunding is alive and well—especially for consumer-facing, revenue-generating local businesses.

Advice for investors: Understand the terms. Equity could yield long-term capital gains, while debt offers fixed repayments. SAFEs are more speculative, offering no ownership until conversion.

Company Types: Niche, Local, or Scalable?

These campaigns span a rich variety of industries and business models:

Food & Beverage (6): The Cumin Club, Fortunato Chocolate, Chainsaw LA, Alkali Rye, The Forgotten Flour, 22 Salute Spirits

Technology (3): Harmony Turbines, Imago Rehab, Netsave

Real Estate Fund (1): ROI Investment Fund

Entertainment (1): American Stories Entertainment

EV/Green Energy (1): CHARGiQUiTY

Retail & Experiences (2): Space Bar, The Farm at Emerald Valley

Key Insight:

Main Street businesses (bakeries, farms, restaurants) succeeded with debt on community-oriented platforms like Honeycomb and SMBX.

Growth startups used equity or SAFE on Wefunder, StartEngine, or Andes Capital.

ROI Investment Fund raised the most capital—$1.87M—via equity, reflecting how real estate syndications are leveraging Reg CF.

Mini Case Studies: Lessons from the Crowd

ROI Investment Fund – $1.87M Raised (Equity, CrowdFund My Deal)

A real estate fund focused on multi-family housing, this campaign demonstrates how Reg CF can now serve institutional-grade deals. Promising a 10% annual return, it attracted nearly $2M—testament to the public’s interest in real estate-backed investments.

Takeaway: Reg CF isn’t just for startups anymore. Mature asset classes like real estate can thrive with the right investor pitch.

Harmony Turbines – $844K Raised (Preferred Equity, Andes Capital)

With two patents and a strong eco-value proposition, Harmony Turbines offers a residential wind turbine that could transform energy use. Its campaign shows how green hardware can find backing through regulated crowdfunding.

Takeaway: Cleantech is gaining momentum. IP-backed startups with tangible products can appeal to investors seeking sustainability and innovation.

The Cumin Club – $717K Raised (Equity, StartEngine)

With 1.8M meals served and $3.6M revenue in 2023, this Indian food delivery brand blends authenticity with scalability. It's a culturally rich business with proven demand.

Takeaway: Strong traction and a relatable founder story win hearts—and dollars.

Fortunato Chocolate – $189K Raised (SAFE, Wefunder)

Built on a rare cacao variety and direct farmer relationships, Fortunato Chocolate is proof that vertical integration and storytelling are key ingredients to a successful Reg CF campaign.

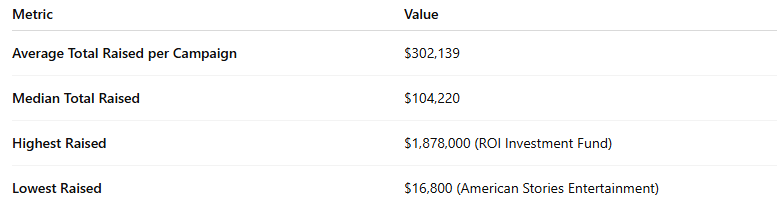

Average Funding Breakdown

Interpretation: While many small businesses raise under $100K, outliers are now raising well over $500K—showing that large campaigns are not only possible, but increasingly common.

Insights for Founders

1. Get your numbers right.

Investors want to see:

Revenue or traction

Valuation justification

Use of funds

Exit plan or ROI projection (especially for equity deals)

2. Choose the right platform.

Each platform has a vibe. Match your brand to the investor community. For example:

Honeycomb Credit → great for brick-and-mortar or local food and beverage businesses.

Wefunder → ideal for scaling tech or social impact ventures.

PicMii → new/small campaigns that want quick attention with light compliance.

3. Tell a great story.

In crowdfunding, narrative is everything. Visuals, founder videos, and testimonials build trust and relatability.

Tips for Investors

1. Diversify your portfolio.

Treat Reg CF like angel investing. Spread your bets across industries and stages.

2. Know the terms.

Understand whether you’re buying equity, debt, or a SAFE. How do you get your money back? When? What’s the risk?

3. Back what you believe in.

Whether it’s green energy or community-based businesses, your capital can help shape the future—while generating returns.

The Bigger Picture: Why Regulated Investment Crowdfunding Matters

This $4.2M+ snapshot shows a vibrant ecosystem of businesses that don’t fit the Silicon Valley mold but still have strong consumer demand and investor appeal.

RIC democratizes access to capital for:

Underrepresented founders

Local businesses without VC appeal

Innovative concepts in early stages

And it empowers everyday investors to move from consumers to owners.

Final Thoughts

Regulated investment crowdfunding is no longer an experiment—it’s a movement. With over $4.2 million raised across 14 diverse companies, it’s clear that this is a viable financing route for mission-driven startups and a powerful wealth-building tool for retail investors.

Expect continued growth, higher average raise amounts, and more sophisticated investor behavior. Whether you’re a founder or

an investor, the time to get involved is now.

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, Rancho Affordable Housing (Proactive), Dopple, and Kaylaan. Learn more about advertising with us here.

Max-Impact Members

The following Max-Impact Members provide valuable financial support to keep us operating:

Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | Lory Moore, Lory Moore Law | Marcia Brinton, High Desert Gear | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Ralf Mandt, Next Pitch | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

Impact Cherub Club Meeting hosted by The Super Crowd, Inc., a public benefit corporation, on August 19, 2025, at 1:30 PM Eastern. Each month, the Club meets to review new offerings for investment consideration and to conduct due diligence on previously screened deals. To join the Impact Cherub Club, become an Impact Member of the SuperCrowd.

SuperCrowdHour, August 20, 2025, at 12:00 PM Eastern. Devin Thorpe, CEO and Founder of The Super Crowd, Inc., will lead a session on "Your Portal, Your Future: How to Choose the Right Reg CF Platform." With so many investment crowdfunding portals available today, selecting the right one can be overwhelming for both founders and investors. In this session, Devin will break down the critical factors to consider—such as platform fees, audience demographics, compliance support, industry focus, and overall user experience. Whether you're a founder planning a raise or an investor exploring where to put your dollars to work, you’ll walk away with a clearer understanding of how to evaluate and choose the platform that best aligns with your goals. Don’t miss this practical, insight-packed hour designed to help you take your next step in the Reg CF ecosystem with confidence.

SuperCrowd25, August 21st and 22nd: This two-day virtual event is an annual tradition but with big upgrades for 2025! We’ll be streaming live across the web and on TV via e360tv. VIPs get access to our better-than-in-person networking, including backstage passes, VIP networking and an exclusive VIP webinar! Get your VIP access for just $25. A select group of affordable sponsorship opportunities is still available. Learn more here.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events

Devin Thorpe is featured in a free virtual masterclass series hosted by Irina Portnova titled Break Free, Elevate Your Money Mindset & Call In Overflow, focused on transforming your relationship with money through personal stories and practical insights. June 8-21, 2025.

Join Dorian Dickinson, founder & CEO of FundingHope, for Startup.com’s monthly crowdfunding workshop, where he'll dive into strategies for successfully raising capital through investment crowdfunding. June 24 at noon Eastern.

Future Forward Summit: San Francisco, Wednesday, June 25 · 3:30 - 8:30 pm PDT.

Regulated Investment Crowdfunding Summit 2025, Crowdfunding Professional Association, Washington DC, October 21-22, 2025.

Impact Accelerator Summit is a live in-person event taking place in Austin, Texas, from October 23–25, 2025. This exclusive gathering brings together 100 heart-centered, conscious entrepreneurs generating $1M+ in revenue with 20–30 family offices and venture funds actively seeking to invest in world-changing businesses. Referred by Michael Dash, participants can expect an inspiring, high-impact experience focused on capital connection, growth, and global impact.

Call for community action:

Please show your support for a tax credit for investments made via Regulation Crowdfunding, benefiting both the investors and the small businesses that receive the investments. Learn more here.

If you would like to submit an event for us to share with the 9,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.