2025 Year in Review: Regulated Investment Crowdfunding Comes of Age

How SEC‑regulated, FINRA‑portal campaigns reshaped startup funding—and what’s next for 2026

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more about our affordable options.

Note to Our Valued Subscribers:

As we celebrate the holiday season, we’re taking a brief pause from our regular posts to share this special article with you. We hope it adds value to your journey and keeps you inspired as the year comes to a close. Wishing you a joyful holiday season and a prosperous New Year filled with opportunities and success! Thank you for being part of our community. 🎉🎄

🎯 Dive into the inspiring stories of successfully funded impact crowdfunding campaigns and discover how they’re driving change! Click the link below to explore.

Note: This article synthesizes patterns from U.S. Regulation Crowdfunding (Reg CF) and related SEC‑regulated offerings through FINRA‑registered funding portals and broker‑dealers. Figures below are directional estimates based on market trajectories through late 2024–2025, not official statistics.

2025: The Year Reg CF Stopped Being “Experimental”

By 2025, SEC‑regulated investment crowdfunding was no longer a curiosity on the fringe of venture finance. It had:

Crossed roughly $1B in annual capital raised under Reg CF and Reg A alone.

Attracted repeat founders, ex‑VC‑backed teams, and post‑revenue small businesses.

Seen professional investors use FINRA portals as part of structured rounds—not just for “community top‑ups.”

Several structural factors drove this shift:

The $5M cap increase (from 2021) fully normalized. By 2025, founders and lawyers had real case law, patterns, and templates.

Portal tooling matured. Analytics dashboards, conversion tracking, investor CRM, compliance workflows, and post‑raise update tools reduced friction.

Investor education improved. Retail investors were more familiar with equity and revenue‑share crowdfunding, risk disclosures, and the long‑term nature of these investments.

Regulatory comfort increased. The SEC and FINRA had several years of supervision data; portals evolved internal controls rather than experimenting in the dark.

Result: successfully funded campaigns in 2025 looked less like “one‑off experiments” and more like repeatable, data‑driven capital formation machines.

Market Overview: Successfully Funded Reg CF Campaigns in 2025

Key observation: 2025 combined volume growth with slightly higher success rates, implying better campaign fit, more realistic targets, and improved execution.

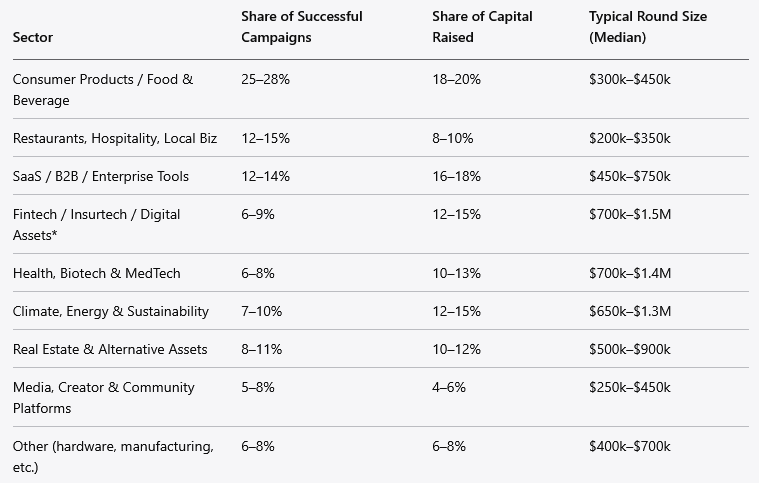

Sector Breakdown: Where the Money Went

Capital by Sector (Successful 2025 Campaigns)

*Fintech here excludes unregistered token offerings; only SEC‑compliant campaigns via FINRA portals.

Deep‑dive insights:

Consumer & CPG still dominate by count, but capital is shifting toward B2B, climate, and fintech, where round sizes are larger and success rates are driven by traction and regulatory tailwinds.

Real estate and alternative asset vehicles (e.g., income‑sharing or asset‑backed SPVs) continued to grow as investors look for yield and partial inflation hedges.

Climate and sustainability moved from “impact niche” to “macro thesis,” especially where linked to real assets (solar projects, energy storage, circular manufacturing).

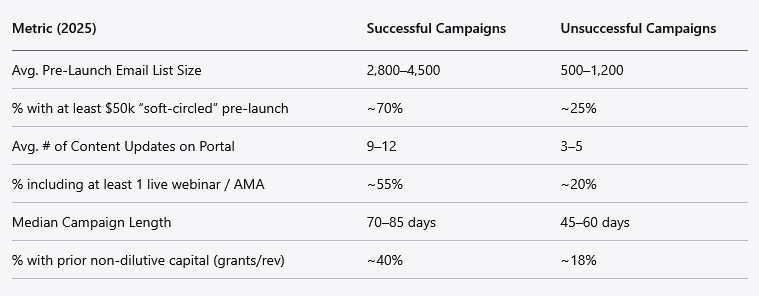

What Distinguished Successful Campaigns in 2025?

Looking only at campaigns that met their minimum, several statistically meaningful patterns emerged.

Quantitative Patterns

Interpretation:

Pre‑commitment (“soft‑circling”) was decisive. Campaigns that lined up at least 15–25% of their minimum target before public launch very rarely failed.

Email > Social. Social media helped awareness, but email lists and direct relationships correlated far more strongly with dollars raised.

Longer, but not endless. The sweet spot for funded campaigns clustered around 70–90 days, with clear launch, mid‑campaign, and final‑push arcs. Short “30‑day sprints” rarely worked unless the minimum was very low.

Structural / Strategic Traits

The majority of successfully funded campaigns had at least three of these five features:

Pre‑existing product or service in the market—not just a prototype.

Clear, simple security structure (e.g., standardized SAFE, revenue share, or common equity).

Compelling use‑of‑funds narrative, tied to specific and time‑bound milestones.

Named lead or anchor investors, even if their checks were modest.

Professional‑grade storytelling: concise deck, decent video, thoughtful FAQ, and transparent risk section.

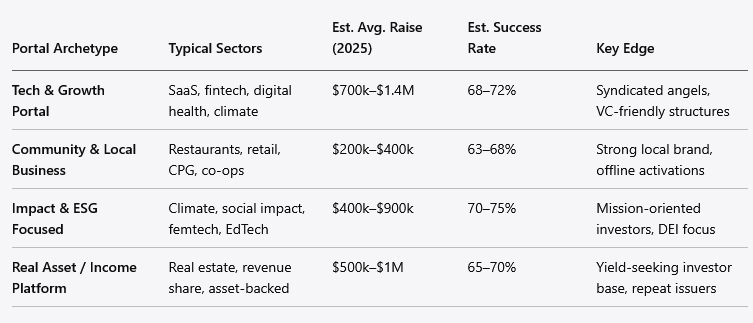

Portal Landscape: FINRA Platforms and Their Emerging Specialties

2025 marked ongoing consolidation among FINRA‑registered portals. While names differ in reality, we can characterize four archetypes and their performance patterns.

Portal Archetypes & Performance (Illustrative)

Unique 2025 development:

Some portals began to behave more like thematic investment networks than neutral pipes. They curated campaigns around climate, diverse founders, or specific geographies, driving higher relevance and repeat investor engagement.

Deeper Analysis: Structural Trends Emerging in 2025

“Campaign Quality Bar” Quietly Rose

While the total number of campaigns increased, low‑effort listings underperformed. Multiple portals adopted subtle but important changes:

Screening committees that turned away obviously under‑prepared issuers.

Higher emphasis on financial hygiene (bookkeeping, clean cap table, basic KPIs).

Stronger requirements for minimum traction or proof of execution, especially in SaaS and hardware.

Result: fewer “idea‑only” campaigns; more post‑revenue or post‑pilot issuers, which helped improve platform‑level performance stats and investor confidence.

The Rise of “Institutionally‑Anchored Reg CF”

An increasing share of large 2025 Reg CF raises (> $1.5M) featured:

Anchor checks from lead angels, micro‑VCs, or strategic corporates.

Public mention of these anchors (within regulatory limits), improving signaling.

Occasionally, sidecar SPVs for accrediteds, with the portal handling the retail flow.

This mixed model produced some of the best outcomes:

Retail investors gained access to higher‑quality deals and better‑negotiated terms.

Issuers benefited from social proof and expertise of professional investors.

Portals captured both volume and credibility.

Data‑Driven Optimization

The more mature portals treated every campaign as an A/B test bed:

Testing various minimum investment levels ($100 vs. $250 vs. $500).

Comparing video lengths and call‑to‑action phrasing.

Optimizing for the critical Day 1–10 window, where momentum strongly predicts eventual success.

Internally, some portals started to deploy machine‑learning based scoring to predict campaign outcomes based on:

Sector

Pre‑launch community size

Geography

Past founder track record

Early investor behavior in the first 7–14 days

These scores weren’t (yet) visible to the public, but they informed portal support allocation—which campaigns to feature, where to deploy marketing resources, and where to advise founders to pause or re‑structure.

Investor Behavior: What 2025 Taught Us

Investors Became More Disciplined (and More Sophisticated)

Compared to 2021–2022, 2025 investors:

Showed less impulsive FOMO and more comparison‑shopping between campaigns.

Paid greater attention to security type, valuation, and dilution.

Were more willing to walk away from poorly structured or under‑disclosed offerings.

Basic but important behaviors became more common:

Building small portfolios (10–20 positions) rather than 1–3 large bets.

Using portal tools (watchlists, auto‑invest, cap‑table visualizations) to track exposures.

Reading Form C filings and financial statements, not just the marketing copy.

Three Distinct Retail Investor Archetypes Emerge

Community Champions

Local supporters, brand superfans, or mission‑driven backers.

Smaller checks ($100–$500), high emotional engagement.

Critical for restaurants, CPG, local venues, and impact startups.

Angel‑Lite Portfolio Builders

Tech‑savvy investors allocating $5k–$25k/year across multiple deals.

Look for higher‑growth SaaS/fintech/healthcare deals.

Care deeply about terms, dilution, and exit pathways.

Yield & Income Seekers

Focused on real estate, asset‑backed deals, or revenue share.

More sensitive to risk disclosures, interest rates, and repayment schedules.

Often older, with lower tolerance for binary startup risk.

Successful campaigns in 2025 knew exactly which archetype they were speaking to and tailored messaging accordingly.

Key Risks & Pain Points Revealed in 2025

Even as the market matured, several systemic issues surfaced.

Post‑Raise Execution Risk Remains High

A successfully funded campaign does not equal a successful company.

Some issuers under‑invested in post‑raise governance, reporting, and runway management, eroding investor trust over time.

Disclosure Comprehension Gap

Even with proper SEC disclosures, many retail investors misunderstood liquidation preferences, SAFE mechanics, or revenue‑share waterfalls.

Education improved, but expectations around time‑to‑exit and probability of loss were still often unrealistic.

Follow‑On Capital Bottlenecks

Companies that raised $500k–$1.5M in 2023–2024 often hit an awkward middle zone in 2025—too big for another pure community round, too small or early for traditional Series A.

Some portals started piloting follow‑on vehicles, but the ecosystem is not yet fully formed.

Operational Load on Founders

Running a Reg CF campaign is time‑intensive—marketing, investor Q&A, compliance, content updates—often at the expense of core operations.

Founders without a dedicated internal owner for the raise struggled the most.

Looking Forward: Predictions for 2026

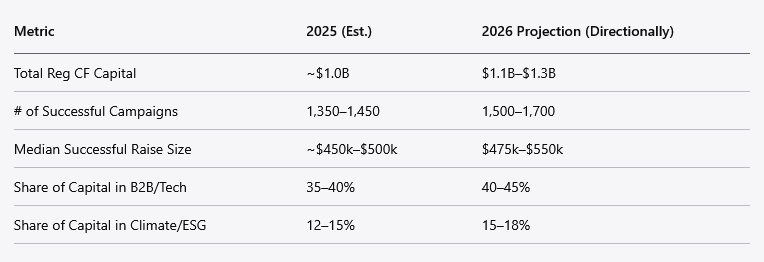

Quantitative Outlook

Assuming continued regulatory stability and modest macro growth:

Expectation: Growth continues but slightly decelerates in percentage terms; the market is transitioning from “hyper‑growth” to steady compound growth with better quality control.

Structural & Regulatory Themes for 2026

More Hybrid Offerings (CF + A + D)

Expect more campaigns where Reg CF is integrated with Reg A+ or Reg D from day one, rather than bolted on.

Documentation and cap‑table tools will evolve to handle multi‑class, multi‑exemption structures with less friction.

Standardization of Terms

Movement toward standard SAFEs, standardized disclosure templates, and more comparable metrics will reduce cognitive load for investors.

Some portals may launch “preferred term sheets” and publicly badge campaigns that follow them.

API‑First Crowdfunding

2026 could see more white‑label and embedded investment experiences, where the user invests on a brand’s website or app while the actual transaction is executed by a FINRA‑regulated portal/tPA in the background.

More Granular Investor Protection Tools

Expect experimentation with suitability questionnaires, risk‑profiling dashboards, and scenario simulators (e.g., “If this SAFE converts at X valuation and the company exits at Y, your outcome range is Z”).

These tools could help reduce misaligned expectations and regulatory concerns.

Data‑Backed Policy Conversations

With nearly a decade of history, policymakers and regulators will have enough longitudinal data to revisit limits, disclosures, and possibly even the $5M cap in limited contexts.

Any changes will likely be cautious but may tilt toward expanding responsible access rather than constraining it.

Strategic Guidance for Startups in 2026

When Reg CF Makes Strategic Sense

Reg CF through a FINRA portal is most compelling when at least two of these are true:

Your customers or fans are your natural investors (consumer brands, communities, platforms, creator businesses).

You’re raising $300k–$3M and can show concrete traction but may not yet fit the classic VC pattern.

You want pricing flexibility and are comfortable with a large number of small shareholders or SAFE holders.

You value the marketing, loyalty, and proof‑of‑market that a public raise can generate.

If you only need $150k–$250k and don’t have a broad audience yet, grants, revenue‑based financing, or local debt might be more efficient.

How to Prepare for a 2026 Raise

Build an Investor‑Ready Community Now

Grow an email list, user slack/Discord, or customer group.

Share educational content about your market, not just product promotions.

Clean Up Your Financial and Legal House

Get at least reviewed financials, even if audits aren’t required at your raise size.

Simplify your cap table; close outstanding friends‑and‑family notes or document them clearly.

Design Your Round as a Narrative Arc

Why this amount? Why now? What milestones become possible?

Map 12–18 month milestones to specific uses of funds (hiring, inventory, product features, regulatory approvals).

Allocate Real Resources to the Raise

Treat the campaign as a product launch, with a launch owner, budget, and clear KPIs (conversion rates, email click‑through, average check size).

Plan Post‑Raise Investor Relations

Decide upfront: quarterly updates, annual shareholder letters, and how you’ll handle FAQs.

Use portal tools or third‑party platforms to centralize communications.

Strategic Guidance for Investors in 2026

Building a Smart Crowdfunding Portfolio

Diversify Aggressively: 15–30 positions at small ticket sizes will generally produce better risk‑adjusted outcomes than 2–3 large speculative bets.

Anchor on Four Core Questions:

Is the problem big and real?

Is there credible traction or proof of demand?

Are the terms (valuation, security) within a reasonable band vs. peers?

Is the team executing well (not just good storytellers)?

Use Post‑Raise Behavior as a Signal: Issuers who communicate well and hit early milestones often merit follow‑on investment when available.

Red Flags to Watch For

Very high valuations with no revenue and little IP.

Overly complex or novel instrument structures that you can’t easily explain back to yourself.

Sparse or evasive answers in the Q&A section.

Heavy emphasis on buzzwords (AI, Web3, etc.) without clear business fundamentals.

Big Picture: What 2025 Tells Us About the Future of Startup Capital

2025’s successfully funded, SEC‑regulated crowdfunding campaigns through FINRA portals point toward a deeper shift:

Capital formation is becoming more participatory. Founders can raise from customers, fans, and local communities alongside traditional angels and VCs.

The line between “public” and “private” markets is blurring. Retail investors are participating earlier, long before IPO or SPAC.

Data and standardization are slowly taming the chaos. Portals, regulators, and market participants are converging on better practices, even if unevenly.

If 2020–2022 were the experimental years and 2023–2024 were the adolescence of regulated crowdfunding, 2025 looks like the beginning of early adulthood for the asset class.

For 2026, the opportunity—for both startups and investors—is not just to raise or deploy more capital, but to do so with greater discipline, transparency, and alignment, turning investment crowdfunding from a novelty into a durable pillar of the entrepreneurial ecosystem.

Make an Impact with Exclusive Investment Insights

Are you ready to align your investments with your values? Impact Members of the SuperCrowd receive exclusive weekly picks from Devin Thorpe, spotlighting innovative ventures that drive social good while offering potential financial returns.

Gain access to carefully selected opportunities that empower communities, promote sustainability, and deliver real change. Don’t just invest—make an impact.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, RISE Robotics, and Crowdfunding Made Simple. Learn more about advertising with us here.

Max-Impact Members

(We’re grateful for every one of these community champions who make this work possible.)

Brian Christie, Brainsy | Cameron Neil, Lend For Good | Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | John Berlet, CORE Tax Deeds, LLC. | Justin Starbird, The Aebli Group | Lory Moore, Lory Moore Law | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Mike Green, Envirosult | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

SuperGreen Live, January 22–24, 2026, livestreaming globally. Organized by Green2Gold and The Super Crowd, Inc., this three-day event will spotlight the intersection of impact crowdfunding, sustainable innovation, and climate solutions. Featuring expert-led panels, interactive workshops, and live pitch sessions, SuperGreen Live brings together entrepreneurs, investors, policymakers, and activists to explore how capital and climate action can work hand in hand. With global livestreaming, VIP networking opportunities, and exclusive content, this event will empower participants to turn bold ideas into real impact. Don’t miss your chance to join tens of thousands of changemakers at the largest virtual sustainability event of the year.

Demo Day at SuperGreen Live. Apply now to present at the SuperGreen Live Demo Day session on January 22! The application window is closing soon; apply today at 4sc.fun/sgdemo. The Demo Day session is open to innovators in the field of climate solutions and sustainability who are NOT currently raising under Regulation Crowdfunding.

Live Pitch at SuperGreen Live. Apply now to pitch at the SuperGreen Live—Live Pitch on January 23! The application window closes January 5th; apply today at s4g.biz/sgapply. The Live Pitch is open to innovators in the field of climate solutions and sustainability who ARE currently raising under Regulation Crowdfunding.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events.

Join UGLY TALK: Women Tech Founders in San Francisco on January 29, 2026, an energizing in-person gathering of 100 women founders focused on funding strategies and discovering SuperCrowd as a powerful alternative for raising capital.

If you would like to submit an event for us to share with the 10,000+ members of the SuperCrowd, click here.

We utilized AI to efficiently gather data and analyze key success factors, enabling us to deliver an overview of these successful crowdfunding campaigns.

Impressive data synthesis on how Reg CF matured from experiment to repeatable system. The shift toward institutionally-anchored rounds is kinda validating what smaller angels have been saying for years about signal quality mattering more than pure volume. Seeing portals deploy ML-based scoring to predict outcomes is fascinatingbut also raises questions about whether that risk-sorting becomes self-fulfilling. When I worked with earlystage issuers, the ones who understood their investor archetype before launch consistently outperformed.