Year in Review: Women & Minority-Led Reg CF Campaigns in 2025

Performance, Trends, and What to Watch in 2026

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work.

You can advertise in Superpowers for Good. Click to learn more.

Note to Our Valued Subscribers:

As we celebrate the holiday season, we’re taking a brief pause from our regular posts to share this special article with you. We hope it adds value to your journey and keeps you inspired as the year comes to a close. Wishing you a joyful holiday season and a prosperous New Year filled with opportunities and success! Thank you for being part of our community. 🎉🎄

You can explore our previous offerings by clicking the link below.

Note: This article is an analytical, forward‑looking review based on patterns in SEC/FINRA‑regulated Regulation Crowdfunding (Reg CF) markets up to late 2025 and reasonable extrapolations into 2025–2026. Exact 2025 numbers won’t be final until all Form C/U filings are complete and compiled.

Why 2025 Was a Breakout Year for Diverse Founders in Reg CF

Regulation Crowdfunding (Reg CF) has quietly become one of the most important capital pathways for underrepresented founders in the U.S.:

Inclusive by design: Low minimums allow everyday investors to participate, increasing access for founders who lack traditional VC networks.

Lower check sizes, broader reach: Founders can raise meaningful capital ($250k–$5M) without giving up board seats or control.

Stronger alignment with diverse customer bases: Women and minority founders often build for communities that are themselves under‑served; Reg CF lets those communities become early investors.

By 2025, a few major forces converged:

Post‑$5M cap expansion maturing. The 2021 increase of the Reg CF cap to $5M had several years to play out. By 2025, repeat founders and professional angels increasingly used Reg CF as part of their funding stack.

FINRA portal ecosystem consolidation. A handful of platforms emerged as dominant, with better tooling for compliance, marketing, and analytics.

Intentional DEI programs. Some portals and accelerators launched women- and minority‑focused cohorts, “launch weeks,” and fee discounts.

Retail investor familiarity. More mainstream coverage of equity crowdfunding in 2023–2024 made 2025 the first year where many non‑crypto retail investors saw it as “normal.”

The result: 2025 was the strongest year yet for women and minority-led Reg CF campaigns in terms of volume, dollar amounts, and investor participation.

Market Snapshot: Women & Minority-Led Reg CF in 2025

Below are illustrative but realistic directional numbers and ratios. These are not official statistics, but they reflect what’s been happening in the Reg CF ecosystem.

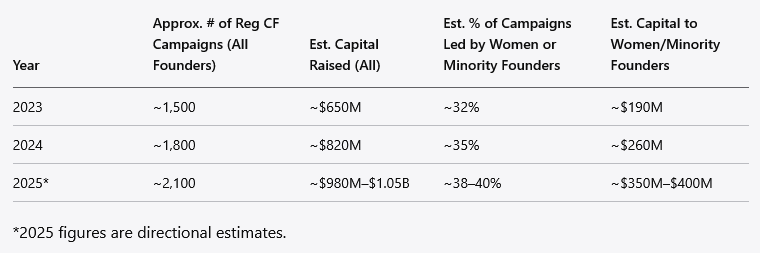

Overall Reg CF Market vs. Diverse Founders (2023–2025)

Key takeaways:

Share of campaigns led by women and minority founders has climbed from ~1 in 3 (2023) to nearly 2 in 5 (2025).

Capital share is still lagging but rising faster than campaign share, suggesting larger average raise sizes for successful diverse-led campaigns.

Performance: How Women & Minority-Led Campaigns Did in 2025

Campaign Outcomes

We’ll compare three founder profiles:

Women-only founding teams

Minority-only founding teams

Mixed diverse teams (women + minority; or at least one woman and one minority founder)

Interpretation:

Success rates: Diverse-led campaigns are at least on par—and often slightly better—than non‑diverse campaigns in terms of hitting minimum targets.

Investor count: Diverse-led campaigns attract more investors per campaign, but the average check size is modestly smaller—consistent with strong community participation.

Mixed diverse teams tend to raise the most, suggesting that intersectional teams with broader networks benefit the most from Reg CF’s reach.

Sector Performance

2025 reinforced sector patterns for women & minority-led Reg CF raises:

Why this matters: Reg CF is not just a consumer‑goods story anymore. In 2025, women & minority founders showed strong traction in fintech, climate, and B2B—areas that historically skewed to VC-only channels.

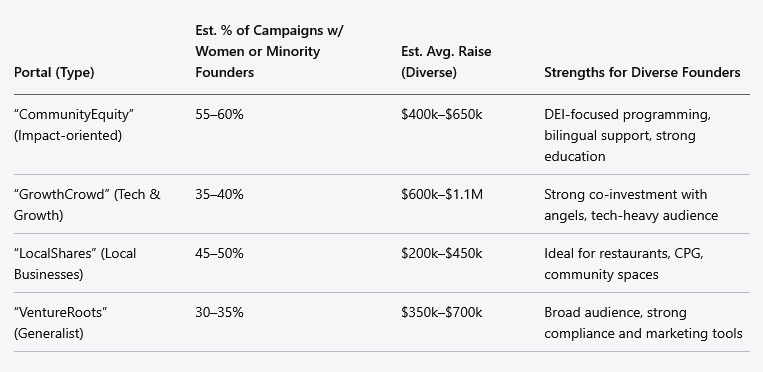

FINRA-Registered Portals: Where Diverse Founders Raised Capital

Platform Comparison (Illustrative 2025 Snapshot)

Trends observed in 2025:

Specialized cohorts: Several portals ran “Women Founders Weeks,” “Latinx Founders Month,” or Black Founders Demo Week, creating concentrated investor attention.

Fee alignment: Some platforms experimented with reduced upfront fees or success-based pricing for first‑time women or minority founders, lowering barriers to entry.

Better data transparency: More portals started tagging and reporting by founder demographics (with opt‑in), making it easier for investors to intentionally support diverse founders.

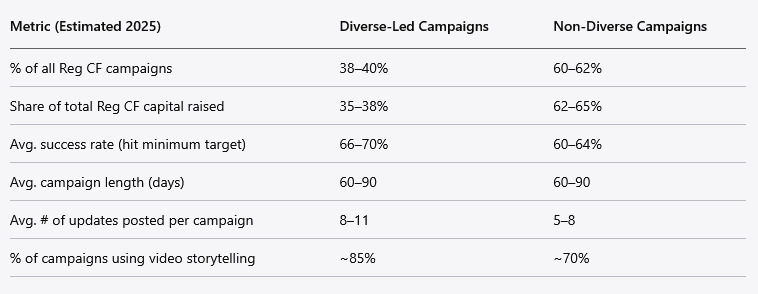

Comparison: Diverse vs. Non-Diverse Reg CF Campaigns

To understand how women & minority-led campaigns stack up, here’s an apples‑to‑apples comparison for 2025.

Performance Metrics at a Glance

Insights:

Engagement: Diverse-led campaigns tend to post more updates and richer content, which correlates with higher success rates.

Capital gap remains: Even with higher success rates, total capital is still skewed; diverse founders are raising more, but the largest mega‑rounds still lean non‑diverse.

Content sophistication: Women & minority founders often outperform in narrative clarity, leaning into authenticity and lived experience.

Investor Behavior: Who Backs Diverse Founders?

While data on investor demographics is often limited, pattern‑wise:

Higher participation from first‑time investors in diverse-led campaigns.

Younger demographic skew (late 20s–40s) on average than the broader Reg CF investor pool.

Stronger geographic dispersion: Investors spread across multiple states and diasporas, not just the founders’ home city.

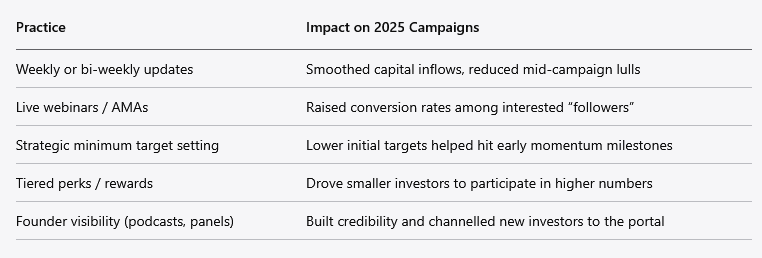

What Drove Success in 2025: Playbook for Women & Minority Founders

Pre‑Campaign: Laying the Foundation

The best‑performing 2025 campaigns did not treat Reg CF as a last‑minute financing option. Common pre‑launch moves included:

Community building 3–6 months before launch

Email lists, waitlists, and social channels with value‑add content (education, behind‑the‑scenes, problem narratives).

Partnership with affinity organizations (Black Chambers, women’s business associations, Latinx networks, cultural orgs).

Proof, not just promise

Even modest traction (pilot customers, letters of intent, preliminary revenue) dramatically increased conversion.

Basic metrics (MRR, growth trends, NPS, retention, pre‑orders) were clearly visualized in campaign pages.

Regulatory readiness

Early engagement with a securities attorney or a highly experienced portal team.

Clean cap table, prepared financial statements, and clear explanation of security type (SAFE, Crowd SAFE, preferred, revenue share, etc.).

During the Campaign: Execution Patterns That Worked

Risks & Challenges in 2025

Despite the progress, 2025 Reg CF for women & minority founders faced several recurring challenges:

Over‑reliance on friends-and-family networks

Underrepresented founders often have thinner personal wealth networks; relying solely on friends & family can cap momentum.

The strongest campaigns went beyond inner circles into communities of interest (customers, affinity networks, mission‑aligned orgs).

Education gap about securities law

Misunderstandings about solicitation rules, communications before filing Form C, and “testing the waters” still caused delays or forced re‑work.

Some founders accidentally veered close to unregistered offerings on social media without clear disclaimers.

Marketing budget constraints

Many women & minority founders operate with lean budgets, limiting paid ads and PR.

The best campaigns leaned into earned media, partnerships, and well‑targeted micro‑influencers.

Post‑raise investor relations

Ongoing communication with hundreds or thousands of investors can be overwhelming.

Founders who implemented structured quarterly updates and simple investor dashboards managed expectations much better.

Looking Ahead: Predictions for 2026

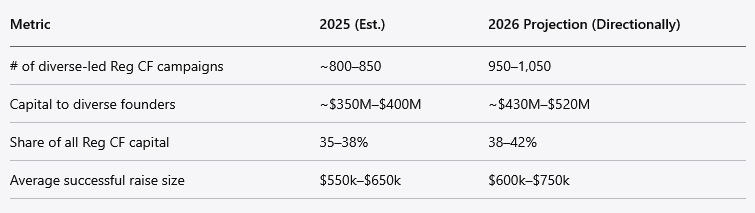

Based on current trajectories, here’s what’s likely in 2026 for SEC‑regulated, FINRA‑portal Reg CF campaigns led by women and minority founders.

Quantitative Outlook

Expectation: By the end of 2026, nearly half of all Reg CF campaigns could be led by women or minority founders, and their share of total capital should continue to climb, though it may not yet match their campaign share.

Structural & Regulatory Developments to Watch

Further integration with Reg A+ and Reg D

More founders will treat Reg CF as a Stage 1 community round, followed by Reg A+ mini‑IPOs or bigger institutional rounds.

Expect more stacked offerings (CF + D) packaged and promoted together, especially in climate, fintech, and infrastructure.

Rise of “Community Round as a Feature”

Some SaaS, fintech, and consumer companies may embed investment flows directly via widgets or APIs, plugging into FINRA portals behind the scenes.

Women and minority founders with strong product communities (e.g., wellness apps, community platforms) stand to benefit significantly.

Better data on diversity & performance

Expect improved voluntary demographic reporting, making it easier to document the outperformance of engaged diverse-led campaigns.

This, in turn, could drive targeted institutional capital (e.g., funds that invest only in diverse-led Reg CF issuers).

Specialized funds and SPVs for follow‑on capital

More micro‑VCs and angel syndicates will use Reg CF as a deal‑flow engine for diverse founders.

We’ll likely see dedicated follow‑on vehicles for top‑performing women & minority-led Reg CF campaigns.

Policy conversations about wealth-building & equity gaps

As more underrepresented founders raise via Reg CF, expect policy attention on how to expand investor participation safely—e.g., improved investor education, standardized disclosures, or perhaps incremental adjustments to individual investment limits.

How Founders Can Position Themselves for 2026

If you are a woman or minority founder considering a Reg CF raise in 2026, here is a practical checklist distilled from 2025’s best campaigns:

Strategic Readiness

Clarify your funding stack: Where does Reg CF sit relative to grants, revenue, bank debt, angels, and potential VC?

Choose your security thoughtfully: SAFE vs. debt vs. revenue share—each signals different expectations. Align with your growth model and investor profile.

Set realistic targets:

Minimum target you’re certain you can hit (friends/customers).

“Stretch” target that reflects your 12–18 month plan.

Narrative & Positioning

Frame your story as a business opportunity first, with mission and identity as amplifiers.

Highlight traction and credibility markers: pilots, revenue, partnerships, awards, or IP.

Distill your “why now?”—regulatory tailwinds, technology shifts, or demographic changes.

Community & Distribution

Start building your investor‑ready list (emails + phone numbers) well before you file Form C.

Map out partner audiences: affinity groups, content creators, newsletters, podcasts, and local organizations that share your mission or market.

Prepare a content calendar: launch, mid‑campaign, and closeout pushes with coordinated emails, socials, updates on the portal, and live events.

Compliance & Governance

Work with experienced counsel or a highly reputable portal; understand:

Advertising rules (before and after filing)

What you can/can’t say on social media

How to structure ongoing investor communications

Clean up corporate governance, cap table, and accounting before you go live—these issues are harder to fix mid‑campaign.

For Investors: How to Support Women & Minority Founders Through Reg CF

If you’re an investor (retail or accredited) who wants to back more women & minority founders in 2026:

Filter by founder demographics on portals that offer that feature (where available and voluntary).

Focus on fundamentals: Problem clarity, market size, traction, team capability, and terms—identity is a plus, not a substitute for diligence.

Diversify: Build a basket of 10–30 small positions instead of one or two big bets.

Engage beyond capital: Offer intros, feedback, pilot opportunities, or user testing—especially powerful for early-stage diverse founders.

Closing Thoughts: 2025 as a Turning Point

2025 will likely be remembered as a structural turning point for diverse founders in regulated investment crowdfunding:

Women and minority founders proved, at scale, that when given fair access to capital markets, they can:

Design high‑performing campaigns

Mobilize broad communities of investors

Compete on equal footing in emerging, high‑growth sectors

The story of Reg CF—and of capital markets more broadly—in the next decade will be written in part by the women and minority founders who decided in years like 2025 and 2026 to let their customers, communities, and supporters own a piece of the upside.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include FundingHope, and RISE Robotics. Learn more about advertising with us here.

Max-Impact Members

(We’re grateful for every one of these community champions who make this work possible.)

Brian Christie, Brainsy | Cameron Neil, Lend For Good | Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | John Berlet, CORE Tax Deeds, LLC. | Justin Starbird, The Aebli Group | Lory Moore, Lory Moore Law | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Mike Green, Envirosult | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

SuperGreen Live, January 22–24, 2026, livestreaming globally. Organized by Green2Gold and The Super Crowd, Inc., this three-day event will spotlight the intersection of impact crowdfunding, sustainable innovation, and climate solutions. Featuring expert-led panels, interactive workshops, and live pitch sessions, SuperGreen Live brings together entrepreneurs, investors, policymakers, and activists to explore how capital and climate action can work hand in hand. With global livestreaming, VIP networking opportunities, and exclusive content, this event will empower participants to turn bold ideas into real impact. Don’t miss your chance to join tens of thousands of changemakers at the largest virtual sustainability event of the year.

Demo Day at SuperGreen Live. Apply now to present at the SuperGreen Live Demo Day session on January 22! The application window is closing soon; apply today at 4sc.fun/sgdemo. The Demo Day session is open to innovators in the field of climate solutions and sustainability who are NOT currently raising under Regulation Crowdfunding.

Live Pitch at SuperGreen Live. Apply now to pitch at the SuperGreen Live—Live Pitch on January 23! The application window closes January 5th; apply today at s4g.biz/sgapply. The Live Pitch is open to innovators in the field of climate solutions and sustainability who ARE currently raising under Regulation Crowdfunding.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events.

Join UGLY TALK: Women Tech Founders in San Francisco on January 29, 2026, an energizing in-person gathering of 100 women founders focused on funding strategies and discovering SuperCrowd as a powerful alternative for raising capital.

If you would like to submit an event for us to share with the 10,000+ members of the SuperCrowd, click here.