Your Friends Are Making Money and a Difference—Join 'Em

The Impact Cherub Club Is Growing

In the last year, people have invested $500 million through crowdfunding. I’m not talking about GoFundMe, Kickstarter or Indiegogo. Nope. Investment crowdfunding is similar but different.

You don’t donate your money. You don’t get the promise of a long wait time for a new game or tech product. You make an actual investment with a formal agreement that you’ll receive a share of the profits, ownership or repayment with interest.

Many companies raising money aren’t just building great companies, they are building their communities or solving social problems.

We formed the Impact Cherub Club at the beginning of the year to jointly review investment opportunities that can make us money while making a difference. Our next meeting is on June 21st at 3:00 Eastern. Register here.

The is no cost to join, no obligation to invest, just a group of thoughtful people working to share insights about choosing impact investments via crowdfunding. We’re having fun!

May Meeting Report

At our last meeting, we listened to brief due diligence reports presented by club members on three companies: EchoMind AI, LiL’ Libros, and Oscilla Power. After listening to the diligence reports, members took a vote on each. Ultimately, the group recommended investing in two of the three companies.

For now, we’ve decided not to share the recommendation of the club outside of the club. If you’d like to know what we’re seeing, selecting and recommending, please join us on June 21st at 3:00 Eastern. There is no cost to participate; you don’t have to invest anything ever. When members choose to invest, I don’t touch the money and don’t earn any fees, commissions or favors.

Education Moment

Each month we take a few minutes for an “education moment” to become better, more sophisticated investors. In May, we discussed the importance of tracking investments.

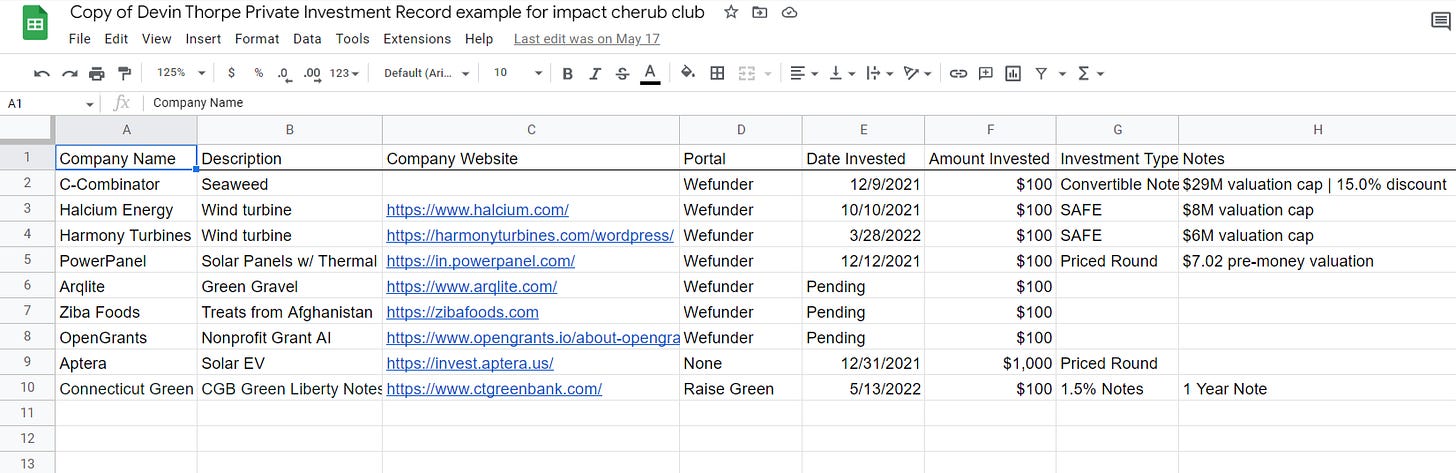

Some fee-for-service providers do this, but even small fees can wipe out returns on small investments. I created and shared a spreadsheet I’m using to track my crowdfunded investments.

This simple spreadsheet, which you can copy, edit and use, is a literal copy of my crowdfunding investment record as of about May 1st, 2022.

Recording your investments and making specific notes about how you can contact the company or the portal where you invested is essential. The portal will likely help you keep in touch with the company, too, but knowing how to follow up if something happens to the portal adds a layer of safety to your investment.

At a minimum, you’ll want to record the URL for the company so you can track them down in the future.

Of course, we all hope the investments grow in value and provide risk-appropriate returns, but there are no guarantees. By tracking your portfolio, you can avoid a scenario where the company does well, and you don’t know about it.

New Company Screening

In preparation for the June 21st meeting, we reviewed three candidate companies. After preliminary discussion, we agreed to consider all three for investment. The three companies are briefly profiled below with links to their offerings on crowdfunding sites.

Trella Technologies

Trella Technologies, led by CEO Aja Atwood, an African American female entrepreneur, has patented indoor agricultural equipment that teaches plants to grow horizontally, allowing for higher yields. Initially developed for cannabis, the company is raising money to expand its market to include food. Trella is raising money on Wefunder with a valuation cap of $30 million and a minimum investment of $100.

Xense

Xense, led by CEO and founder Ying Zhao, a female entrepreneur, has patented a radical upgrade in CT technology, improving the resolution, reducing the cost of the equipment and shrinking the size. Hence, it requires less space and cuts the amount of radiation exposure to the patient. Xense is raising on Wefunder with a valuation cap of $205 million and a minimum investment of $100.

Flux Hybrids

Flux Hybrids, led by CEO Michael Ulrich, who recently completed his master’s in mechanical engineering, is converting gasoline-powered fleet vehicles, light-duty trucks, to plug-in hybrids affordably and profitably. The company’s conversion provides a 4-year payback at gas prices of just $2.50 by cutting fuel requirements 50 percent. Flux Hybrids is raising on Wefunder with a valuation cap of $6 million and a minimum investment of $100.

Next Meeting—June 21st, 2022, at 3:00 PM Eastern

At our next meeting on June 21st, 2022, at 3:00 PM Eastern/Noon Pacific, consistent with our plans for future sessions, the agenda will have three items:

Diligence Reports

Education

Preliminary Consideration of New Candidates

Diligence Reports

We’ll begin with the due diligence reports from the Impact Cherub Club members who volunteered to do the research. After hearing the members’ reports, we’ll vote to determine whether or not to recommend investment in the companies. The decision will be made available to everyone who registers to attend, including those who don’t make it. Register here.

Education Moment

This month we’re going to look at organizing and formalizing due diligence. When venture capitalists or private equity professionals make investments, they typically spend months researching the candidate investment, often hiring professionals to help.

That scale of due diligence makes economic sense when investing millions of dollars, but not so much when investing $100. Still, we should be doing as much as possible as a group to make thoughtful investments based on meaningful analysis. Join us to learn more about doing your due diligence before investing in private companies.

Preliminary Review of New Candidates

At our June meeting, we’ll be following the pattern of past months to conduct a preliminary review of three companies raising money via Regulation Crowdfunding on FINRA-registered portals. If you have identified a social enterprise or community-building company raising money via investment crowdfunding, feel free to recommend that to me for consideration next month.

Here is a bit of information about each of the three we’ll consider this month.

Cabinet Health is scaling a business intending to reinvent the pharmaceutical industry to be radically more sustainable by replacing typical plastic containers with biodegradable ones. The plastics used not only harm the environment but also us, possibly offsetting some of the benefits of the drugs. The diverse management team is leading the raise on Republic.

In partnership with the Climate Action Fund, this project financing opportunity intended to yield 5 to 8 percent annually brings solar power to a low-income community. The project will install solar panels on a Baltimore school roof, and the energy will be sold to homes in the neighborhood at 75 percent of what they currently pay, saving them money. The diverse team is raising money on Raise Green.

Founder Kristal Hansley is scaling her solar enterprise in Baltimore, Maryland. (I see no direct connection to the project above.) WeSolar provides homes and businesses with affordable clean energy. No upfront or installation fees. Anyone paying an electric bill can enroll in a community solar project. WeSolar is raising money on Raise Green.

Please join us for the monthly Impact Cherub Club meeting on June 21st at 3:00 PM Eastern. There is no cost or obligation. We’re genuinely having fun! Register here for free.

Don’t forget that we’re hosting the biggest impact crowdfunding event of the year, SuperCrowd22, on September 15 and 16, 2022. Our free subscribers can register for the event for just $99.50, half off the $199 public price. Join us today!