Beyond the Rooftop: Why Climate Investing Is Now a National Security Issue

Why our capital—not just our consumption—may be the most powerful climate lever we have

Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions. When you purchase an item, launch a campaign or create an investment account after clicking a link here, we may earn a fee. Engage to support our work. You can advertise in Superpowers for Good. Click to learn more.

Most of us understand the first step of climate action: use less fossil energy.

Drive less (or drive electric).

Electrify your home.

Insulate and air-seal.

Install solar (if you can).

That’s all essential. But today’s headlines make something else painfully clear:

If we want fewer “oil temptations” on the world stage, we also need to fund the alternatives—at scale—beyond our own roofs.

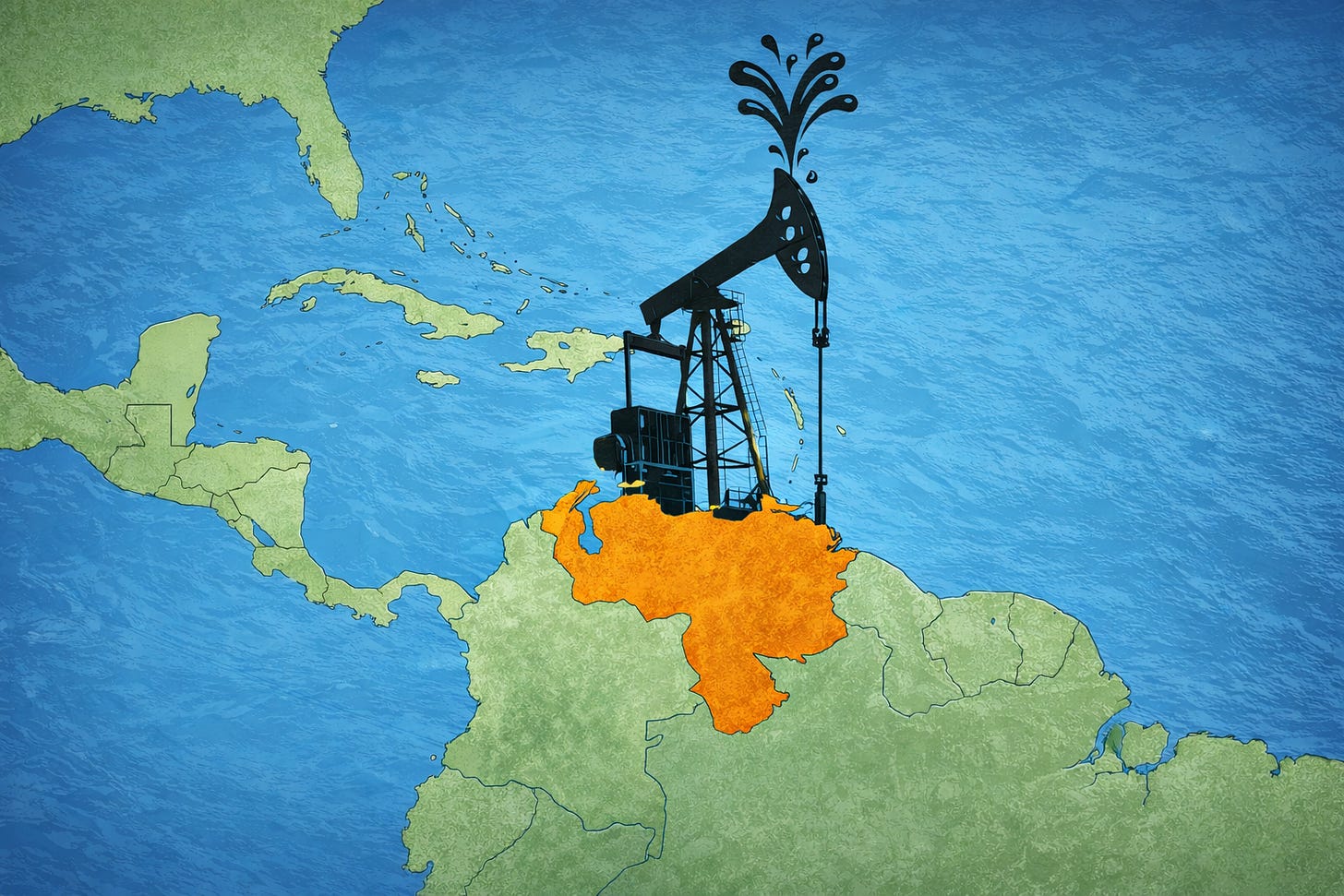

Venezuela is a flashing red warning light

This week, President Trump ordered a raid that resulted in the capture of Venezuelan President Nicolás Maduro, who was taken to New York to face charges. Reports indicate that at least 40 people died in the operation.

At the same time, Trump has openly discussed U.S. intentions to “partake” in Venezuela’s oil industry. And yes—Venezuela’s reserves are enormous, often cited at around ~300 billion barrels—the world’s largest.

Whatever someone thinks about Maduro, the pattern here is the point:

When oil remains strategically central, oil-rich countries become targets—politically, economically, and sometimes militarily.

So here’s the thesis of this post:

Every incremental investment that accelerates clean energy deployment marginally reduces future oil demand—and marginally reduces the geopolitical incentive to seize oil.

It’s not the only reason to invest in climate solutions. But it’s becoming one of the most urgent.

The credibility problem (and why it matters)

Trump has used drugs as an excuse for action against Venezuela, but he lacks something key: credibility.

Trump recently issued a controversial pardon related to a major Honduras drug trafficking case, which prompted significant public debate about motives and standards.

Against that backdrop, “this is about drugs” arguments land differently—especially when oil is openly discussed.

I’m not asking you to agree with my political read. I’m asking you to see the structural risk:

As long as oil is the prize, leaders will keep reaching for oil—by pressure, by coercion, and sometimes by force.

The “second step” of climate action: invest beyond your own roof

Personal consumption choices matter. But consumption-only climate action hits a ceiling fast:

Not everyone owns a home.

Not every roof works.

Not every household can afford the upfront cost.

And even when we do everything “right,” the grid, industry, and transportation systems still need trillions in upgrades.

That’s where investment becomes a form of climate action.

Investing doesn’t just “express values”—it builds capacity

When you invest in renewable energy and climate solutions, you help:

finance new solar, storage, and electrification projects,

fund the companies building the tools,

and prove demand for a cleaner economy—so more capital follows.

In plain English: investment builds the future you want to live in.

Why regulated investment crowdfunding is the best on-ramp for most people

For decades, the best climate investments were effectively reserved for institutions and high-net-worth insiders.

Regulated investment crowdfunding (Reg CF) changes that.

It allows everyday people to invest directly in early-stage ventures and real-world projects—often with minimums that feel accessible—while still requiring formal disclosures.

Is it risk-free? Absolutely not. These investments are typically illiquid and speculative. But if you’ve been looking for a way to back climate solutions with more than good intentions, Reg CF is one of the most practical, scalable paths available to individuals.

And this is exactly why I’m so excited about what we’re building with SuperGreen Live.

The other huge problem: Trump is cutting clean energy funding

While all of this is happening abroad, the Trump administration has also moved to terminate billions in clean energy project funding in the U.S.

That matters for jobs, grid modernization, innovation—and speed.

But it also creates a blunt reality:

If federal support is being yanked away, private capital becomes even more important.

We can’t replace all public funding with individual investments. But we can help close gaps, accelerate timelines, and keep promising solutions alive long enough to scale.

Another corollary: China is eating our lunch on the clean energy economy

There’s a competitiveness angle here that’s hard to ignore.

On solar manufacturing cost competitiveness, the International Energy Agency notes China is the most cost-competitive location across the solar PV supply chain, with manufacturing costs materially lower than the U.S.

On EVs, the IEA reports China produced 12.4 million electric cars in 2024—more than 70% of global production.

Strategic analysts have been warning that the U.S. is falling behind China in clean energy technologies and critical minerals.

So when we invest in clean energy innovation here—through regulated, compliant channels—we’re not just “being green.”

We’re investing in whether the U.S. remains a first-tier player in the economy that’s coming.

A note on public markets—and why they fall short for climate investors

In the days following the violent apprehension of Nicolás Maduro, U.S. equity markets moved higher, driven in part by expectations that greater access to Venezuelan oil could lead to lower long-term oil prices.

From a conventional market perspective, that reaction makes sense.

From a climate perspective, it’s deeply troubling.

The market’s signal was clear: oil abundance is still being priced as good news.

That highlights a structural misalignment many climate-focused investors already feel but don’t always name: public markets are optimized for short-term price efficiency, not long-term planetary outcomes. They tend to reward whatever lowers costs and boosts margins today—even when those gains are tied to violence, instability, or the expansion of fossil fuel supply.

For investors seeking climate solutions, this moment underscores a hard truth:

The stock market is not reliably aligned with our values or our goals.

That doesn’t mean public markets have no role. They can provide diversification, liquidity, and exposure to large clean-energy players. But when oil prices fall because force has secured new supply—and markets cheer—that’s a reminder that systemic change rarely originates in the public markets alone.

In contrast, when we invest directly in renewable energy projects, grid modernization, storage, electrification, and climate-focused companies, we’re not just reacting to market signals—we’re creating new ones. We’re helping to build the infrastructure that makes oil less central, less profitable, and ultimately less worth fighting over.

What “investing beyond your roof” can look like

When people hear “invest in renewables,” they often think it means putting panels on their own home.

But there’s another path that’s been growing rapidly:

financing renewable projects

backing climate-focused companies early

investing in community-scale solutions where your dollars unlock real-world deployment

At SuperGreen Live, we’re spotlighting exactly these pathways.

For example, one of the featured voices, Jackie Logan of Raise Green/Honeycomb Credit, will discuss how everyday investors can use Regulation Crowdfunding to back real-world climate and clean energy projects.

SuperGreen Live: where climate capital meets real-world solutions

SuperGreen Live runs January 22–24, 2026, streaming globally across Roku, Amazon Fire TV, Regen Media TV, and other devices via the e360tv Network.

It’s free to watch, with an optional $25 VIP upgrade for deeper engagement.

This isn’t just inspiration. It’s about execution—how capital actually moves, how founders actually fund, and how investors can participate responsibly.

The programming includes leaders who understand the capital stack from multiple angles—startup scale, compliant fundraising, marketing reach, and citizen advocacy.

Live Pitch: investable climate offerings, on a global stage

SuperGreen Live includes a televised Live Pitch session where founders present active Regulation Crowdfunding offerings—so viewers can go from “I like that” to “I’m invested,” in real time.

Our judges, all active investors, will pick the Judges’ Choice Award winner, and the audience will choose their favorite, becoming the SuperCrowd Award winner.

Demo Day: non-judged climate innovation showcase

Demo Day is open, uplifting, and non-judged—built for visibility and storytelling across the sustainability landscape.

(If you know a builder who should be seen, send them here. The roster is almost full, but we’re continuing to accept applications for the final few spots.)

Practical next steps

Here’s a simple approach that doesn’t require perfection:

Do what’s next to address energy use: rooftop solar, efficiency, EV replacement.

Invest today: Back a climate project on Climatize with $10 just to prove to yourself you can do it!

Learn the rules of the game: how Reg CF works, what Form C disclosures contain, what risks are normal.

Start small and diversify: one deal is a gamble; a thoughtful basket is a strategy.

Register for SuperGreen Live: investing is powerful; investing and showing up is even more so. Join us for SuperGreen Live; register here.

Support Our Sponsors

Our generous sponsors make our work possible, serving impact investors, social entrepreneurs, community builders and diverse founders. Today’s advertisers include RISE and SuperGreen Live. Learn more about advertising with us here.

Max-Impact Members

(We’re grateful for every one of these community champions who make this work possible.)

Brian Christie, Brainsy | Cameron Neil, Lend For Good | Carol Fineagan, Independent Consultant | Hiten Sonpal, RISE Robotics | John Berlet, CORE Tax Deeds, LLC. | Justin Starbird, The Aebli Group | Lory Moore, Lory Moore Law | Mark Grimes, Networked Enterprise Development | Matthew Mead, Hempitecture | Michael Pratt, Qnetic | Mike Green, Envirosult | Dr. Nicole Paulk, Siren Biotechnology | Paul Lovejoy, Stakeholder Enterprise | Pearl Wright, Global Changemaker | Scott Thorpe, Philanthropist | Sharon Samjitsingh, Health Care Originals | Add Your Name Here

Upcoming SuperCrowd Event Calendar

If a location is not noted, the events below are virtual.

SuperCrowdHour, January 21, 2026, at 12:00 PM Eastern. Devin Thorpe, CEO and Founder of The Super Crowd, Inc., will lead a session on “From $10 to Impact: How Anyone Can Become an Impact Investor.” Drawing on his experience as an investment banker, impact investor, and community-building leader, Devin will explain how everyday people can start investing small amounts to support mission-driven companies while pursuing financial returns. In this session, he’ll break down the basics of regulated investment crowdfunding, show how impact and profit can align, and share practical steps for identifying opportunities that create real-world change. As an added benefit, attendees can become an Impact Member of the SuperCrowd for just $4.58 per month to receive an exclusive private Zoom meeting invitation with Devin, free tickets to paid SuperCrowd events, and the opportunity to directly support social entrepreneurs, community builders, and underrepresented founders.

SuperGreen Live, January 22–24, 2026, livestreaming globally. Organized by Green2Gold and The Super Crowd, Inc., this three-day event will spotlight the intersection of impact crowdfunding, sustainable innovation, and climate solutions. Featuring expert-led panels, interactive workshops, and live pitch sessions, SuperGreen Live brings together entrepreneurs, investors, policymakers, and activists to explore how capital and climate action can work hand in hand. With global livestreaming, VIP networking opportunities, and exclusive content, this event will empower participants to turn bold ideas into real impact. Don’t miss your chance to join tens of thousands of changemakers at the largest virtual sustainability event of the year. Learn more about sponsoring the event here. Interested in speaking? Apply here. Support our work with a tax-deductible donation here.

Demo Day at SuperGreen Live. Apply now to present at the SuperGreen Live Demo Day session on January 22! The application window is closing soon; apply today at 4sc.fun/sgdemo. The Demo Day session is open to innovators in the field of climate solutions and sustainability who are NOT currently raising under Regulation Crowdfunding.

Live Pitch at SuperGreen Live. Apply now to pitch at the SuperGreen Live—Live Pitch on January 23! The application window closes January 5th; apply today at s4g.biz/sgapply. The Live Pitch is open to innovators in the field of climate solutions and sustainability who ARE currently raising under Regulation Crowdfunding.

SuperCrowd Impact Member Networking Session: Impact (and, of course, Max-Impact) Members of the SuperCrowd are invited to a private networking session on January 27th at 1:30 PM ET/10:30 AM PT. Mark your calendar. We’ll send private emails to Impact Members with registration details.

Community Event Calendar

Successful Funding with Karl Dakin, Tuesdays at 10:00 AM ET - Click on Events.

Join UGLY TALK: Women Tech Founders in San Francisco on January 29, 2026, an energizing in-person gathering of 100 women founders focused on funding strategies and discovering SuperCrowd as a powerful alternative for raising capital.

If you would like to submit an event for us to share with the 10,000+ changemakers, investors and entrepreneurs who are members of the SuperCrowd, click here.

Manage the volume of emails you receive from us by clicking here.